While most people in the machine tool business are pretty satisfied with U.S. sales of late, it now looks like 2013 is shaping up to be an even stronger year for machine tool consumption. According to Steven R. Kline, director of market intelligence for Gardner Business Media, Gardner’s recently completed Capital Spending Survey indicates an 8 percent increase next year in machine tool orders over what is estimated to be a very good 2012.

According to Kline, orders for new metalcutting equipment are forecast to be $6.634 billion next year. That follows year-over-year increases of 89 percent and 8 percent, respectively, in 2011 and 2012, based on estimated final sales for those years.

How can the machine tool market be doing so much better than the general economy? “On the surface, the absolute dollar amount and percent increases are hard to believe because we have been conditioned to such a difficult machine tool market for the last decade,” Kline says. “However, I am quite confident that the forecasted number is reasonable for a number of reasons.”

Among those reasons:

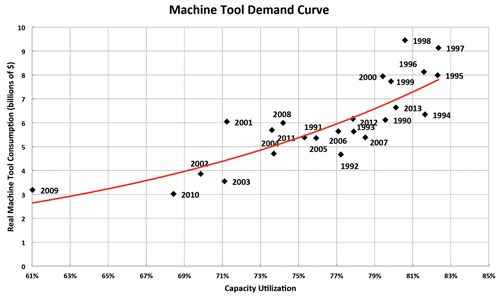

• Operating capacity is projected to be around 80.1 percent, the highest mark since 1999, when machine tool sales in real dollars were $7.732 billion. Given that level of capacity utilization, the 2013 projection is very close to optimal demand (see chart below).

• Industrial production is growing very rapidly. Year-over-year industrial production has been growing since June 2010, and, while production has cooled in recent months, the annual rate of growth has increased each of the last eight months.

• Since 1970, average machine tool sales in real dollars have been $6.082 billion, so this year’s forecast is only about 10 percent above the historical average.

• Reshoring is a very real phenomenon, according to Kline. “Gardner’s 2012 Top Shops survey showed that 18 percent of shops were booking business that was coming back from overseas,” he says.

• Companies prefer machines to labor. Skilled labor continues to be in short supply. Also, increasing healthcare and benefits costs are making it less desirable to hire.

Some of the equipment types projected to see exceptionally large increases next year include large horizontal machining centers, smaller turning centers (less than 10-inch chuck), CNC screw machines, small-hole EDM, and rotary transfer equipment. Hot industries for spending include automotive, forming and fabricating (non-auto), military, oil, gas-field and mining machinery, and job shops.

Kline notes that small shops are going to present a very good market for equipment. “Shops with 1-19 employees will increase nearly 400 percent, which is most of the overall gain in sales,” he says. “These shops are likely benefitting the most from reshoring and are probably the most reluctant to hire. Plus, these shops buy when they have new work and are therefore the most sensitive to capacity utilization and industrial production trends.”

Unlike other capital spending projections, Gardner’s Capital Spending estimate is based on surveying end users and asking their specific spending intentions by machine type. The projection is then derived from statistical analysis of the end-user sample. The survey has historically been among the most accurate predictors of spending.

.png;maxWidth=45)

.png;maxWidth=150)

.jpg;maxWidth=300;quality=90)