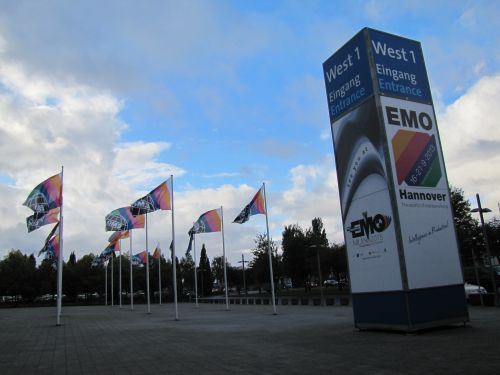

EMO 2007--A Bright Reflection Of The Times

EMO 2007, a major machine tool show held in Hannover, Germany, in September, will not be remembered for the new technology introduced at this show, although it was not without its noticeable highlights. Rather, it will be remembered as the show with a record number of attendees generating record numbers of sales leads and purchase agreements. This surely reflects the strong economic growth in the major industrial markets around the globe.

Share

Hwacheon Machinery America, Inc.

Featured Content

View More

ECi Software Solutions, Inc.

Featured Content

View More

EMO 2007 will not be remembered for the new technology introduced at this show, although it was not without its noticeable highlights. Rather, it will be remembered as the show with a record number of attendees generating record numbers of sales leads and purchase agreements. Show sponsors report that 166,000 visitors came to the show, which is 4 percent more than the attendance at the previous event in 2005, even though the show was shortened by 2 days. More than 2,100 exhibitors filled close to 2 million square feet of exhibit space.

Almost all of the exhibitors were pleased (and some were positively ecstatic) with the results of the show. This surely reflects the strong economic growth in the major industrial markets around the globe.

So, general impressions of the technology on display may be more meaningful than mentions of particular innovations. That’s good because a show of this size makes it difficult to survey individual technology offerings thoroughly. However, a representative sampling of the new and interesting products at EMO is available online. Go to www.mmsonline.com/articles/120704.html for a “slide show” of the items and developments that caught the editors’ eyes during EMO’s 6-day run.

Getting Their Acts Together

At the time of the last EMO, a number of machine tool builders and technology providers were in the midst of reorganization, consolidation or product repositioning. At this year’s show, the results of that process were apparent. Machine tool brands that seemed thrown together 2 years ago were presented in a coherent and logical array, with common color schemes and design features for a unified corporate image.

This observation applies most noticeably to MAG Industrial Automation Systems, a corporate conglomerate of 13 different brands that includes Fadal, Giddings & Lewis, Cincinnati Machine, Hüller Hille and other familiar names. MAG IAS had the second largest booth at the show.

Other examples of companies that have realigned products and brands to bring clarity to the marketplace were not hard to find. At the 600 Group, Colchester Harrison now represents a single, coordinated line of lathes formerly offered as separate brands that overlapped or left gaps in the range. A similar melding was evident with the GF AgieCharmilles brand that now covers electrical discharge machines (Agie and Charmilles) and high-performance mills (Mikron) formerly marketed as distinct brands.

In some cases, the effect was more subtle. Hardinge, for example, has been steadily revamping its turning line and its Bridgeport milling line so that both cover the range from entry-level machines to high-performance models. This has been accomplished.

The large number of machine tool builders from China was also remarkable. Show sponsors say 86 exhibitors from mainland China were at the show. Dalian Machine Tool Group’s booth was large and impressive. If the machines at this booth are a reliable indication, it appears that machine tool building in China has done in 5 years what Taiwan did in 10 and Japan did in 20 regarding product functionality and design finesse.

Lots Of Large Parts

At past EMO events, many exhibitors were preoccupied with machining processes for the medical, electronics and IT industries. Thus, the emphasis was on production of very small parts. Zippy little machines taking light cuts at high speeds were typically the center of attention. Not so at this show. Aerospace and energy-related industries (oil field and wind turbine, for example) are driving machine tool consumption in many key markets now. This means a focus on large machines for large workpieces. Rigidity and high torque were the characteristics being touted. Many exhibitors were showing what they could do in steel and titanium machining.

Although the automotive industry in the Unites States is regrouping, European automakers and their suppliers are busily upgrading their capabilities, especially for the production of powertrain components. Here again, larger, high-powered machines for these components are being promoted.

The trend toward machines that combine milling and turning continues, as evidenced at the show. We didn’t see much in the way of new configurations or combinations of multiple spindles and multiple turrets. Most of the new models introduced in this category represented larger or smaller sizes to complete an existing line or series. For large workpieces that are difficult to move around, the advantage of completing milling and turning in one setup is obviously compelling.

Engineered Solutions

For years now, talk of providing solutions rather than stand-alone machines has been prevalent at EMO and other metalworking trade shows. At this show, however, integrated concepts were not presented mainly as ideas or futuristic developments, but as market-ready offerings. It was not unusual to see a mix of machine tools, measuring devices, software applications, tool management systems and other equipment categories working together in a highly automated setting.

Rather than increased metal removal rates, exhibitors pointed to productivity gains flowing from reduced setup, faster change-over, optimized machine settings and so on. Clearly, design engineers have been concentrating their efforts on faster tool changes, fewer delays in pallet changing and more efficient loading and unloading.

Western European manufacturers are definitely very cost-conscious. They understand that cutting production costs is necessary to compete with lower-wage countries, many of which are right on their borders or nearby on the same continent. One senses, though, that these manufacturers are more willing than their counterparts on this side of the ocean to make the capital investments in systems and equipment to minimize non-productive time. Apparently, automation technology is more difficult to sell in North America—not because the interest isn’t there, but because many American companies focus more heavily on the initial price of equipment than the cost savings over time. The purchase price and the potential savings often occupy two different and unrelated budgets within the company’s planning.

Manufacturing Taken Seriously

EMO is a remarkably international show. Visitors from 80 countries were present, according to show sponsors. The number of U.S. visitors to EMO was also up this year. In fact, one of the largest contingents of visitors from overseas was from the United States (along with India).

The level of hospitality in the typical EMO booth may astonish the U.S. visitor. Americans are unaccustomed to encountering what amounts to a small restaurant or café in the middle of even modestly sized booths. Being offered a cold beer is sure to be a welcome, if unexpected, gesture. Yet this show is all about the business of metalworking, and visitors meet with exhibitors to do business. Not much booth space is devoted to extraneous attractions meant to entertain or draw a crowd (yes, we saw sumo wrestlers at one booth).

You do find yourself noting that manufacturing is really taken seriously here—and not just within the industry. The honor and pride of the skilled craftsman is still a hovering influence almost everywhere at EMO, and respect for this tradition extends beyond the fairgrounds. In Germany, EMO attracts national attention. Federal President Horst Köhler came for the opening ceremony and spoke about the significance of this industry. It was a message that almost every listener understood quite well.

Read Next

Building Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read MoreRegistration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read More