A Machine Tool Show In Moscow

The market for metalworking equipment in Russia is enticing but complex.

Share

ECi Software Solutions, Inc.

Featured Content

View More

Autodesk, Inc.

Featured Content

View More

Hwacheon Machinery America, Inc.

Featured Content

View More

Takumi USA

Featured Content

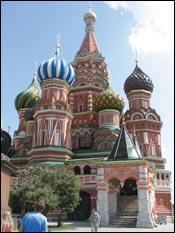

View MoreWhat is a machine tool show in Moscow like? What is Moscow like these days? MASHEX, the Industrial & Technologies For Russia show, has been held every year since 1988. This year, the show moved to the Crocus Center Expo site about 15 miles from the Red Square, which is literally and figuratively the heart of Moscow. (Red Square, by the way, is still properly called such because that color was considered synonymous with beauty when the Kremlin and its cathedrals and palaces were built centuries ago. Their beauty remains, although political revolutions have come and gone.)

The Crocus Center is a modern complex with several large exhibit halls that rival any trade show venue in Europe or North America. The buildings are spacious, clean, functional and tastefully decorated. MASHEX ran for four days (May 29-June 1) during a rare heat wave that drove outside temperatures into the 90s, although the exhibit halls were comfortably air-conditioned. The show can be summed up in the statistics reported by show sponsors: 50,000 square meters of exhibit space; 500 exhibitors; 15,000 attendees. These numbers, however, do not reveal the nature or significance of the show.

It is Russia’s main machine tool show, the place where machine tool sellers and buyers from all over the country convene. What the exhibitors showed and what interested Russians tell much about the metalworking industry there. In general, exhibitors brought their latest and most advanced equipment. To offer anything less, apparently, would be to underestimate the Russian metalworking market. Buyers are as interested in all of the leading technologies and advanced processes as buyers anywhere around world.

On display were five-axis VMCs; multitasking machine tools; lathes for hard turning; wire and ram electrical discharge units; robotic welders; carbide inserts with the newest coatings and geometries; and other recently developed technology.

Although parts of Russia’s economy and social infrastructure are still in catch-up mode, the country is experiencing booms in many industrial sectors. The energy industry is expanding rapidly; a growing middle class is hungry for consumer goods; and the construction industry is at full tilt—tall cranes salute the future on every horizon in the Moscow vicinity, it seems.

To keep up, Russian manufacturers generally want machines capable of handling complex work to close tolerances. They seem to be less interested in automation such as gantry loaders, robotic part transfer or flexible machining systems, although pallet changers that keep machine downtime low are popular. Salaries and benefits are relatively low in Russia, so there is no great pressure to reduce head count in factories.

On The Show Floor

Brand names familiar to U. S. shops were easy to spot. In fact, you often could find machines from the same builder in several booths—in some cases, the very same model appeared in more than one location. Almost every dealer or distributor in Russia exhibits at this show, so even though their territories may not overlap, there is much duplication when they all exhibit their best-selling machines in one location.With the largest market share in Russia, European machine tool builders are the best represented at the show. DMG, Danobat and Index were there, as well as numerous smaller companies serving the industry. Sandvik Coromant, Walter AG and Iscar were among the cutting tool exhibitors. Delcam and Siemens were among the software and CNC suppliers. Builders from Japan were not far behind. Yamazaki Mazak, Mori Seiki, Okuma, Makino and a number of other companies had a strong presence. Don’t bother consulting the show directory for a complete listing of “Who’s Where With What.” Not every dealer or distributor lists all of the lines they carry.

A number of U.S. companies were conspicuous. Haas Automation, Hurco, Hardinge, Gleason, and MAG Industrial (representing Fadal, Cincinnati Machine, Giddings & Lewis, and other brands now in that family) were present, to name a few.

Machine tool building in Russia is not what it used to be, a fact apparent at this show. The Soviet government once supported a thriving group of builders, but many of them had factories in other Soviet-bloc countries. When the USSR disintegrated in the early 1990s, these “machine tool enterprises” lost access to these manufacturing facilities. They also lost captive markets in the trading bloc and lost heavily subsidized production orders from the Soviet government, a triple whammy. Yet several of these companies have managed to regroup and re-establish themselves as key players in the Russian and international markets. These companies had large booths at MASHEX.

Three To Watch

The Ryazan Machine Tool Works, for example, has done well in both Russia and North America. This company specializes in large lathes that are in strong demand from the oil industry and other heavy industries such as rail equipment and shipbuilding. Ryazan showed a flatbed lathe for heavy-duty turning. This machine was recently redesigned to meet specs suggested by its U.S. seller, Shamrock Machinery Co., of Houston, Texas. The company has enlarged the spindle bore to 320 mm, beefed up the headstock to 40-ton capacity, and added a tailstock for parts weighing as much as 25 tons. It features a C axis with independent drive. The bed has three guideways to handle heavy thrust forces while maintaining stability. The earlier version of this model was shown at IMTS 2006 and sold to a U.S. company for machining wind turbine parts. This builder also produces some large slantbed lathes, VMCs and gear-cutting machines, which are sold worldwide.Two other Russian machine tool builders, Savelovo Machine-Building Plant and Ivanovo Heavy Machine Tool Building Works, deserve mention. Each has pursued different strategies in the years since the Soviet break-up while coping with a competitive marketplace without government support. Savelovo diversified. Although 50 percent of its output is still metalcutting machine tools, the company also produces packaging equipment, product test stands and other machines for manufacturing. Most of its machine tools are designed and built to customer specification for special applications in the aviation industry.

Ivanovo, meanwhile, concentrated on large HMCs and machines for hard turning. This builder now focuses on machines for the automotive, energy and defense industries. The machines at the show presented an impressive appearance. The sheet metal guarding, for example, is attractively designed and well made. One large HMC on display featured HSK-63 tooling, a large pallet changer and a Siemens Sinumerik CNC control.

Opportunities

Interest in the next MASHEX show (May 25-30, 2008) has been strong, and bookings of exhibit space are running at a slightly faster pace than for previous shows. AMT–The Association For Manufacturing Technology is considering sponsoring an American pavilion for its members who want to test-market their products. Entering the Russian market must not be taken lightly. In the face of well-established competitors from Europe, Japan or the U.S., potential newcomers have to weigh other options such as approaching India, China or Brazil first. If they do take the plunge in Russia, these companies will have to be patient. Russian buyers like to stick with what they know. They expect support and maintenance to be responsive, effective and reasonable in cost.There is no compelling reason for U.S. machine tool buyers to attend MASHEX, although they would feel quite at home in the exhibit halls. However, U.S. machine tool builders and suppliers need to take a hard look at this show and at the Russian market. Even visiting the show just to talk to distributors and exhibitors would provide a good “feel” for the market. The window of opportunity is not large. In a few years, getting a foothold in Russia will be more difficult. Domestic builders are likely to recapture more of their former vigor and boldness. Foreign companies with a head start will be in a good position to leverage their familiarity with the market and their mastery of its challenges and risks.

For information about MASHEX 2008, visit www.mashex.ru.

An Insider’s View

Mike Richards, president of Shamrock Machinery Co., visits Russia often and was at this show. His comments afterward provide interesting insights:“Russian buyers prefer to purchase Russian machine tools because they feel comfortable with the availability of parts and service. The interesting point is that they will pay a premium for Russian machines for this reason. Next in line are European machines due to familiarity with quality and electronics. But Russian buyers have a high level of respect for American-made machines.

“I noticed a sharp increase in Asian machines at this year’s MASHEX. Typical delivery of Russian made machines is six or more months. The major Asian machine tool builders are willing to put in an inventory of available machines and also to establish a service network. As a result I expect them to do well in the Russian market.”

Read Next

5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read MoreRegistration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read MoreBuilding Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read More

.jpg;maxWidth=300;quality=90)

.jpg;maxWidth=300;quality=90)