How To Turn $378,000 Into $4 Million

Over the years, this tax column has addressed a ton of tax subjects. But never have readers’ responses been greater than they were for two recent items in the column that are sort of cousins.

Share

Hwacheon Machinery America, Inc.

Featured Content

View More

ECi Software Solutions, Inc.

Featured Content

View More.png;maxWidth=45)

DMG MORI - Cincinnati

Featured Content

View MoreOver the years, this tax column has addressed a ton of tax subjects. But never have readers’ responses been greater than they were for two recent items in the column that are sort of cousins. The subjects were income in respect to a decedent (IRD) and subtrusts.

IRD (an unfriendly critter in the tax law) is a problem. (We’ll explain it in a moment.) A subtrust, on the other hand, is a tax friend and, as you will see, offers a total solution to the IRD problem. Important for both IRD and subtrust are qualified plans such as a profit-sharing or pension plan, 401(k) plan, rollover IRA and other such plans. This column is a must-read if you have a substantial amount of money in such plans. The more funds you have in qualified plans, the more you will relish what you are about to read. IRD is a tax-you-twice, dollar-burning monster. Slay the monster or it will destroy your dollars.

First, the problem. Say you have $1 million (please substitute your own amount) in a qualified plan. Every dollar you take out of the plan is subject to income tax. Unless you spend it, the balance (after income tax) is subject to estate tax. In the highest 2003 brackets (35 percent income tax and 49 percent estate tax), your family gets only 33.15 percent—$331,500—out of that $1 million. The IRS gets 66.85 percent—$668,500. Of course, your home state usually grabs a piece of the action, further reducing your family’s share.

Now here’s a tax fact that can really scare you: Under current law, those highest brackets are scheduled to be 40 percent (income tax) and 55 percent (estate tax) in the year 2011. Then your family will only get $270,000. The IRS gets a whopping $730,000 out of that nice $1 million.

Now suppose you die with $1 million in your plan. The IRS gives you a second chance to get clobbered with double IRD taxes. Your heirs, in effect, pay the same amount you would have paid if you had withdrawn the funds during your life. The result: Dead or alive, this is a horrible confiscatory tax! The monster wins.

Now the solution—subtrusts to the rescue. A subtrust allows you to use your plan funds to buy life insurance. Actually, you have a choice: You can have the plan buy insurance on your life (single life) or on you and your spouse (second-to-die). At your death (or you and your spouse if you buy second-to-die), the policy proceeds are paid to your heirs—all estate tax-free. In the real-life world of the taxpayer versus the IRS, a subtrust legally turns the tables on the IRD tax disaster.

Let’s look at a few real-life examples: A married client, Jim, (age 54) with a 53-year-old wife, Mary, had $215,000 in a 401(k) plan (receiving additional contributions of about $12,000 each year). They purchased $2.5 million of second-to-die insurance in the subtrust. The premiums are $19,750 (paid by the subtrust) per year. Jim and Mary’s kids and grandkids are the subtrust’s beneficiaries. Jim got a nice tax-free cash bonus out of the deal: He pocketed $132,000 in cash surrender value on an old $350,000 policy on his life that was no longer needed.

Joe, age 65 and single, had $821,000 in a rollover IRA. If Joe died, the IRD monster would burn (using 2011 rates) $599,330 in taxes, leaving only $221,670 for his heirs. Instead, Joe had his professionals create a new 401(k) plan and rolled the full $821,000 into it. Then a subtrust purchased a $1.2 million policy, with annual premiums of $51,960, on his life. Bye-bye, IRD monster.

Whether you are married or single and you are fortunate enough to have $200,000 (or more) in your qualified plans, a subtrust is probably the best wealth-building opportunity in the entire bag of legal tax strategies. Look into it.

Related Content

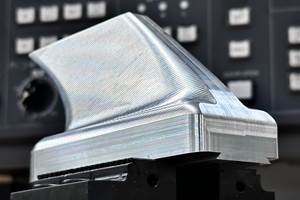

Custom Workholding Principles to Live By

Workholding solutions can take on infinite forms and all would be correct to some degree. Follow these tips to help optimize custom workholding solutions.

Read MoreRethink Quality Control to Increase Productivity, Decrease Scrap

Verifying parts is essential to documenting quality, and there are a few best practices that can make the quality control process more efficient.

Read More6 Variations That Kill Productivity

The act of qualifying CNC programs is largely related to eliminating variations, which can be a daunting task when you consider how many things can change from one time a job is run to the next.

Read More4 Commonly Misapplied CNC Features

Misapplication of these important CNC features will result in wasted time, wasted or duplicated effort and/or wasted material.

Read MoreRead Next

Registration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read MoreBuilding Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read More

.png;maxWidth=150)

.jpg;maxWidth=300;quality=90)