Top Machining Strategies and Equipment

2012 Benchmarking data reveals the machining technologies and techniques world-class shops use to their advantage.

Machine tools continue to improve in accuracy, flexibility and overall performance. In turn, new supporting equipment and software are being developed to enable more efficient and effective machining processes.

As this year’s Top Shops benchmarking data shows, upper-echelon shops are more apt than lower-performing operations to embrace such advanced equipment even though the initial cost might be higher. These Top Shops also tend to spend more consistently on capital equipment and tooling as they invest in the continued success of their business.

A handful of questions from this year’s benchmarking survey asked shops to identify the types of equipment and machining strategies they use on a daily basis. Here are some similarities and notable differences between the technologies applied by the Top Shops and those used by the other shops that took part in the survey.

MACHINE TOOLS

Virtually the same percentage of all shops surveyed use equipment such as VMCs, turning centers and manual mills and lathes. However, the Top Shops are more likely to have HMCs than the other shops (nearly 53 percent versus 42 percent), which is similar to data collected in last year’s survey. In addition, nearly 48 percent of the Top Shops use turn-mill machines versus just 29 percent of the other shops. For the Top Shops, this is nearly 15 percentage points higher than last year’s survey, signaling growing acceptance of the multitasking platform and possibly demonstrating that those complex machines are becoming easier to program and operate. Likewise, more of this year’s Top Shops perform full-five-axis contouring work than the other shops, although essentially the same percentage of shops perform 3 + 2 machining. The latter technique uses the fourth and fifth rotational axes to orient the cutting tool or workpiece in a fixed position prior to machining, rather continuously rotating the axes as the tool cuts.

Table 1 to the left lists data about these and other machining strategies used by the surveyed shops. As mentioned above, the Top Shops are more likely than the other shops to perform advanced, albeit challenging, machining operations. For example, 60 percent of the Top Shops perform high-speed machining versus only 46 percent of the other shops. This extends to turning operations, too, with 48 percent of the Top Shops performing hard turning compared with 38 percent of the other shops. Hard turning is attractive because it offers the chance to eliminate (or at least greatly reduce) secondary grinding operations.

Spindle utilization is one way to gage how effectively shops are using their machine tools. This performance metric is higher at the Top Shops than the other shops, although it’s readily apparent that both have worked to improve it. The Top Shops have increased their spindle utilization from a median value of 70 percent in 2008 to 81 percent in 2011, while the other shops have improved from 60 percent to 70 percent over that same time span.

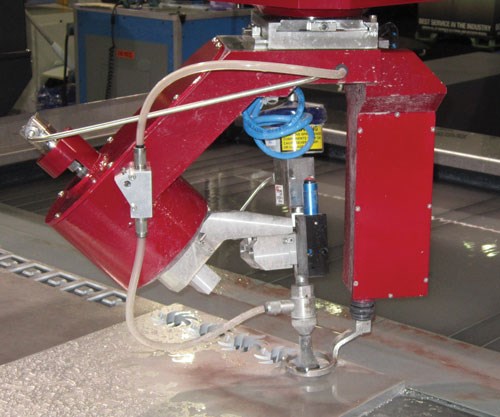

The Top Shops are also more likely than the other shops to have equipment for cutting parts from sheet and plate material. Nearly 18 percent of the Top Shops use waterjet machines versus 9 percent of the other shops. For laser-cutting machines, those values are 15 percent and 8 percent, respectively. All of these percentages are either the same or higher than what was reported in last year’s survey.

CUTTING TOOLS

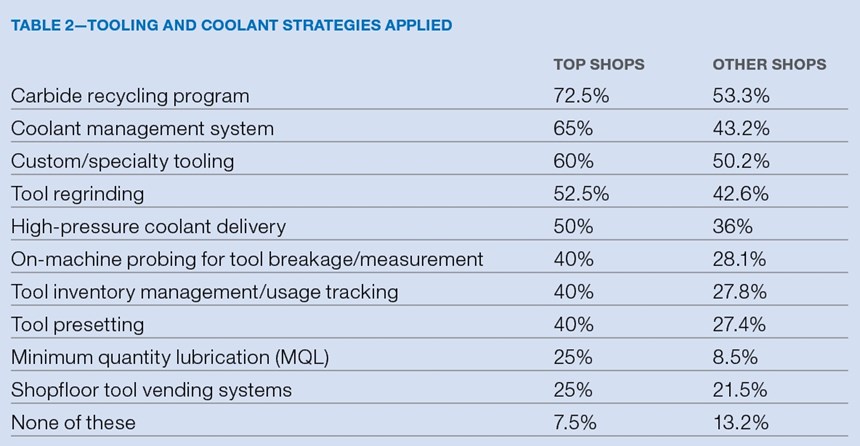

While all shops have increased their spending on tooling in recent years, the Top Shops consistently spend more on an annual basis. One reason for this could be that they are purchasing pricier alternatives to conventional tooling, such as carbide cutters and inserts with advanced substrate and coating technologies. Spending data suggest, however, that better-performing shops are more willing to accept a higher initial price for such quality tooling knowing that they will be paid back in faster cycle times, longer tool life and, in some cases, the capability for one tool to perform multiple operations. Along those lines, a higher percentage of the Top Shops use more costly custom/specialty tools than the other shops, too.

On the other hand, the Top Shops are much more likely to recoup some of their tooling costs by recycling used carbide cutters and inserts. Nearly three-quarters of the Top Shops wisely do this. Carbide scrap is valuable, so it makes economical sense (not to mention environmental sense) to have a formal recycling program in place to recover this material. Many cutting tool suppliers offer recycling programs that make it easy to sell back worn carbide tools. That said, it’s worthwhile to recycle worn high-speed steel cutters, too. Although high-speed steel’s scrap value is just a fraction of carbide, it’s still higher than that of regular steel.

COOLANT

Half of this year’s Top Shops take advantage of high-pressure coolant delivery. By precisely directing the coolant stream at a higher pressure, more heat can be removed from the cut zone. Better cooling enables the tool to remove greater amounts of metal, which speeds cycle times. A high-pressure stream is also more effective in breaking up and removing chips, so tools spend less time re-cutting chips.

In addition, the Top Shops are much more likely than other shops to have a coolant management system (65 percent versus 43 percent). Properly maintained coolant can have an infinite lifespan, so disposal costs can be eliminated. And because the Top Shops recognize the importance of maintaining a clean facility, 45 percent of them use machine mist control units versus 32 percent of the other shops. On the flip side, a number of the Top Shops also employ minimum quantity lubrication (MQL). For the right applications, MQL enables dramatic cuts in coolant costs while protecting workers and the environment. None of this is surprising because data show that the Top Shops often market their business by offering customer tours to demonstrate the pride they have in their facility, equipment and employees.

WORKHOLDING DEVICES

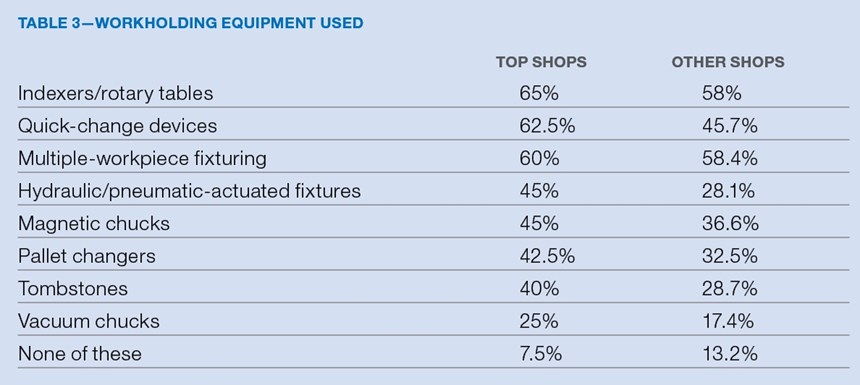

Advanced shops always look for more effective ways to fixture parts for machining, because innovative workholding measures can lead to a wealth of process improvements. One of these is faster setup times. Like last year, this year’s survey shows that the Top Shops have faster setup times than the other surveyed shops. (Using lean’s definition, setup time is the time between the completion of the last good piece of the current run and the first good piece of the next run.) In this year’s survey, the Top Shops reported a median setup time of two hours versus three hours for the other shops.

The Top Shops achieve this performance in part due to equipment such as quick-change workholding devices that enable parts to be easily removed and reinstalled with a high degree of positioning repeatability. The survey shows that 63 percent of them use these devices versus 46 percent of the other shops. Similarly, 45 percent of the Top Shops use magnetic chucks versus 37 percent of the other shops, and 25 percent of the Top Shops use vacuum chucks versus 17 percent of the other shops. Both of these workholding methods enable operators to install and remove parts quickly without the need for traditional clamps or vises.

SOFTWARE

The majority of surveyed shops use CAD/CAM software for part programming. Half of the Top Shops also use toolpath simulation/verification software compared to 41 percent of the other shops. This is not surprising given that the Top Shops tend to perform more complex machining operations in which it’s important to verify tool paths offline to ensure there will be no collisions.

In addition, 43 percent of the Top Shops use job-estimating software versus 28 percent of the other shops. This likely enables the Top Shops to quote jobs with a higher degree of accuracy and consistency. Plus, nearly one-third of the Top Shops use statistical process control/quality management software to streamline measurement data collection and reporting, compared to just 21 percent of the other shops.

INSPECTION DEVICES

Approximately the same percentage of all shops surveyed have CMMs in their quality lab (just shy of 50 percent). However, more of the Top Shops use shopfloor CMMs than other shops (30 percent versus 15 percent) as well as portable measuring arms (19 percent versus 10 percent). Clearly, they recognize the value of providing advanced measuring capability closer to the point of part production.

In addition, 43 percent of the Top Shops use on-machine probes for workpiece measurement versus 27 percent of the other shops. Both of these percentages are higher than last year’s survey results, suggesting that an increasing number of shops find it important to enable their machines to also act as inspection devices despite the slight decrease in spindle in-cut time.

OTHER NOTEWORTHY PRACTICES

While complete survey data comparing the equipment used by surveyed shops can be found in the Executive Summary available at mmsonline.com/topshops, here are a few more interesting findings:

• Machine connectivity—More than half of the Top Shops have machines connected via Ethernet versus just over a third of the other shops. The value of networked CNCs continues to grow as NC file sizes increase. In addition, nearly 8 percent of the Top Shops reported using the MTConnect communications protocol for CNC machines and other manufacturing equipment. It will be interesting to see in future surveys if the number of shops implementing this relatively new standard increases.

• Machine maintenance—A higher percentage of the Top Shops perform routine ballbar calibration and have implemented total productive maintenance (TPM), showing they recognize the value of machine upkeep. In fact, 25 percent of the Top Shops have implemented TPM versus just 12 percent of the other shops.

• Robotic automation—A greater number of all shops surveyed reported using robots for machine loading/unloading compared to last year’s survey. However, nearly 18 percent of the Top Shops have integrated this type of automation, which is almost double the percentage of the other surveyed shops.

• Finishing equipment—The Top Shops are more likely to have secondary finishing and related capabilities. This includes anodizing, passivation, marking and heat-treating equipment. Some shops prefer to have key vendors for these types of processes, but bringing such capabilities in-house can offer better control in terms of quality and turnaround time.

Related Content

Top Shops: Designing a Shop to Meet Customer Needs

Working closely with customers and making careful investments has enabled this Wisconsin machine shop to tackle difficult jobs with tight deadlines as a core part of its business.

Read MoreThe Human Impact of Machining Technology

SSP’s commitment to adopting the latest machining technology benefits not only the business, but its employees as well.

Read MoreTop Shops 2024 Is Now Live

The Top Shops 2024 survey for the metalworking market is now live, alongside a new homepage collecting the stories of past Honorees.

Read MoreRead Next

The Future of High Feed Milling in Modern Manufacturing

Achieve higher metal removal rates and enhanced predictability with ISCAR’s advanced high-feed milling tools — optimized for today’s competitive global market.

Read MoreRegistration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read MoreRego-Fix’s Center for Machining Excellence Promotes Collaboration

The new space includes a showroom, office spaces and an auditorium that will enhance its work with its technical partners.

Read More