Supply Chain Woes Yield Opportunities for Manufacturers

Sponsored ContentAs companies scramble to build more robust supply chains, manufacturing events are aiming to help North American manufacturers find new opportunities.

Share

It is no secret that COVID-19 has exposed the stress points in manufacturing supply chains across the world. Early in the pandemic, manufacturers struggled to keep up with the sudden demand for medical equipment with uncertain supply lines. Personal protective equipment (PPE), for example, went through waves of shortages throughout the summer of 2020 because 90-95% of PPE relied on Chinese companies at some point in the supply line. This means that delays in Chinese manufacturing plants can translate to months of delay for manufacturers in the Americas.

Suppliers and machine shops in both the U.S. and Mexico are facing supply chain issues, but the USMCA may provide opportunities across the southern border.

And these delays are by no means limited to the world of medical manufacturing. Across many manufacturing sectors, industries have been experiencing record-long lead times, according to the United States-based Institute for Supply Management (ISM). This has exposed the need for suppliers who offer better speed to market, even in the face of the benefits of outsourcing. In light of this, governments and companies alike are looking into ways to strengthen local supply lines, as Forbes reports.

Reshoring and Near-Shoring

In this manufacturing environment, the USMCA has reduced trade barriers between Mexico and the U.S. to the point that they function as a single manufacturing market. On top of creating wage parity for Mexican and U.S. automotive workers, it further reduces the tariffs applied to parts crossing the border. These features make competition fairer and improve the accessibility of suppliers from either side of the border, making it easier for U.S. shops to work with Mexican customers and vice versa. As the COVID-19 pandemic slowly peters out this trade deal will have a major impact on the reshoring and near-shoring of North American manufacturing.

In the wake of COVID, North American manufacturers are looking for reshoring and near-shoring opportunities to strengthen the weaknesses in their supply chains. North American manufacturers may be able to leverage their technology and experience to garner new work in this environment.

Reshoring is the opposite of offshoring: It is replacing overseas suppliers with local ones. Near-shoring is similar in that it replaces overseas suppliers with ones from neighboring countries. In reporting on the supply shortage, Forbes has suggested that both reshoring and near-shoring will see a large increase as industries race to protect their supply chains from future disruption.

For Mexico and the U.S., near-shoring means splitting quite a bit of automotive manufacturing that currently occurs overseas between each other. This is far from unusual: Automotive parts are already crossing the Mexican-American border before finding their final destinations. However, the scale of these efforts is likely to increase dramatically in the wake of COVID-19 as companies race to improve their ability to procure parts locally.

There is a tendency to see these events through protectionist lenses, but the reality is that while Mexican shops will be competing with U.S. shops for work, they will also be supplying U.S. shops with work and vice versa. Without trade barriers, the supply chains become interwoven, with new business helping both manufacturing economies to grow. In this interwoven system, both Mexican and U.S. shops are likely to see an increase in business opportunities.

Building relationships with suppliers will be key to taking advantage of the opportunities created by efforts to rebuild the supply chain.

Rebuilding the Supply Chain

As governments and corporations scramble to rebuild supply chains, smaller machine shops have the chance to expand their customer base. Automotive manufacturers are looking to grow their manufacturing presence in North America by 12.5% over the next three years, providing numerous opportunities to suppliers of all tiers.

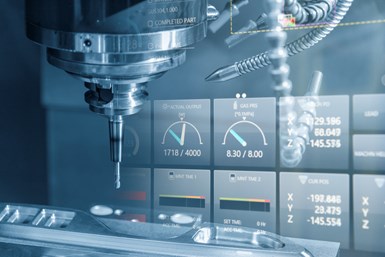

However, the growth in business opportunities for North American shops is not limited to the automotive industry. The medical and consumer goods industries were severely affected by supply shortages, and the semiconductor shortage has several companies sourcing new suppliers with micromachining capabilities for both the electronics and defense industries. Both Mexican and U.S. machining facilities have access to advanced technologies including a variety of automation solutions, providing shops with the capabilities to address these shortages economically despite the higher salary and benefit expectations.

Of course, part of finding new work as the supply chain rebuilds is finding new partners to work with, which is where networking comes into play. Rebuilding the supply chain means building new relationships with customers and other suppliers, and in the new environment created by the USMCA, that means building relationships on both sides of the border. Fortunately, there are manufacturing events that can help put you in contact with new customers and suppliers.

Meet Your New Customers

With the opportunity to build more relationships between suppliers and machine shops across the U.S.-Mexico border, events like FITMA are perfect for making contacts and finding customers.

Trade shows are popular throughout manufacturing because they are extremely effective networking and learning aids. Everyone is there to learn about new technology and get the word out on their products and services, providing many opportunities for new partnerships. Over the next two years in particular, people who are eager to fill gaps in their supply chains will have the perfect chance to meet with both customers and other suppliers with similar goals.

One example of this is FITMA, an event designed specifically to facilitate learning and networking opportunities for machine shops working with partners in Central America. This makes it attractive to any U.S. shop looking to increase business with Mexican suppliers, as well as shops based in Mexico and Central America. As a regional show, it is an excellent place to make contacts for near-shoring opportunities.

Trade shows like FITMA enable attendees to meet with other companies and build business relationships.

Another show that will be colocated with FITMA, the Maufacturing Supply Chain Expo (MSC) is designed to connect buyers and sellers of discrete parts. “MSC is designed to meet the current demand for increased production close to home,” says Claud Mas, publisher of Modern Machine Shop Mexico. “OEMs based in Mexico are looking for qualified manufacturers capable of meeting their needs and improving their supply chains, and we designed this show to help connect these companies to part manufacturers.”

Both FITMA and MSC provide opportunities for machine shops to learn about potential customers. “Thanks to the USMCA, trade across the border is going to increase,” says Mas. “These events will enable both U.S. and Mexican companies to take advantage of the new opportunities this creates.”

For more information, check out FITMA.