Shop Automates Small Diameter Machines

'Processes, not prayers' is a slogan at Starro Precision, a screw machine shop that's taking off like a rocket fueled by tightly focused growth and strategic planning. The use of appropriate technology, including automated bar feed systems, helps maximize resources.

Share

ECi Software Solutions, Inc.

Featured Content

View More

Hwacheon Machinery America, Inc.

Featured Content

View More

Like many metalworking industry segments, screw machine shops are under pressures from several fronts. Sources for these challenges are both external to the business as well as internal—dealing with the production process.

Some of the external dynamics that screw machine shops are dealing with include customer demands for shorter leadtimes on parts with tighter tolerances that are ordered in smaller lot sizes. At the same time, shops are asked to hold the line on prices.

Inside the shop, there are shortages of the skill sets that traditionally have been used to make the complex screw machine tools run. For example, it's increasingly difficult to find qualified setup people to operate the mechanical screw machines.

Getting more productivity from a shop's existing payroll can be accomplished with implementation of CNC screw machines. Further efficiencies are attainable by automating these machines with ancillary equipment such as automatic bar feeders.

So what's new about that? In this story, we're looking at a shop that has found a system that allows it to extend the effective use of magazine-style bar feeders to some very small diameter stock (see sidebar).

A Look At The Details

Lee Dwyer, director of total quality management at Starro Precision (Elgin, Illinois), is frank about his company's success. It's not by magic or miracle, he says. "Where other people can offer a better price, show you a flashy brochure and toss about catchy slogans, we'd prefer to look at the process. The devil really is in the details," he says.

Starro Precision has been around for 40 years. Its 75 employees run Swiss-style cam and CNC screw machines—Stars, Tornos, and Citizens—in the 45,000-square-foot plant they've about outgrown. The company is dominant in valve production, primarily for the automotive, aerospace and medical industries; they also have a presence in telecommunications and fiber optic technology.

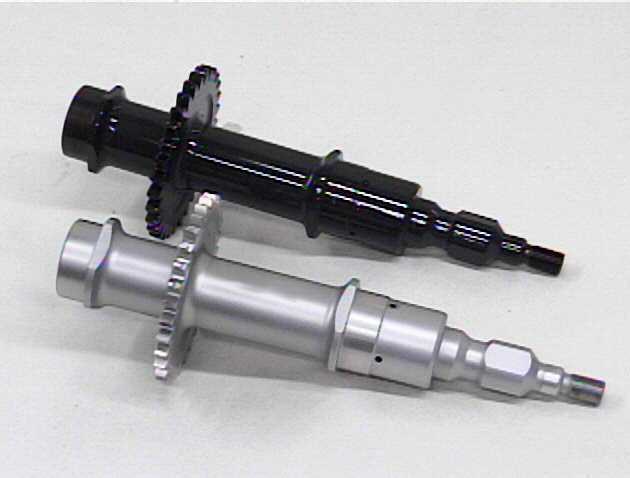

The company processes a wide variety of materials—brass, various shapes of bar stock, 12L14 and 1018, stainless steel, some nickel alloys and titanium. Mr. Dwyer considers Starro's work "micro-machining," turning diameters from 0.060 to 1.0 inch. Typical tolerances are ±0.0002 inch, with critical surface finishes to 4Ra.

"This is very precise work," Mr. Dwyer says, "but our customers demand it. If we don't deliver, they're gone. Anymore, you get one shot, because the competition is absolutely fierce. It's not just the shop down the street or in New Jersey. It's the shop in Mexico, Singapore, and China. America has to go back to leveraging its assets in manufacturing skills and take seriously the inroads that low-cost foreign competitors are making. And the way to do this is through technology."

The technology at issue, in Starro's case, is automation. More specifically, automated bar feeding systems for its small diameter Swiss-type work.

Quantum Leaps (Not Mechanics)

Mr. Dwyer suggests that throughout history every quantum leap forward in productivity has come through technology. Einstein's theories were considered revolutionary at the time, Mr. Dwyer says, but the real revolution took place only when they were applied through technology. The same can be said of the leap from the vacuum tube to the transistor to the microchip.

"This historical perspective is very much a mental backdrop for us as we move forward through the implementation of technology," says Mr. Dwyer. "We've been very calculating in the steps we've taken. We've automated all our bar feeding with IEMCA feeding systems, predominantly their Mini Boss and CH 112 models. We load the magazines once a day, and our operators then are able to do other things."

Mr. Dwyer says the company operates 24 hours a day, seven days a week. Volumes range from 15,000 to 7,000,000 pieces. Running three shifts has decreased manpower by 35 percent, machine count has decreased by almost 40 percent, and net output has increased by more than 25 percent. And this is just the beginning. They have a projected growth forecast of 25 percent a year for the next four years and plan to accomplish it by reducing machinery and increasing automation.

Mr. Dwyer points out that about a year ago the company developed a five-year plan that involved purchasing 20 CNC machines and 20 automatic bar feeding systems. A mere 18 months into the plan, the company has already installed 20 bar feeders with two more of them on order.

"In the last 18 months, we've spent $2.5 million on equipment and another $2.5 million on a new facility we're moving into at the end of the year. And this is all based on controlled growth. Every machine we've bought has been paid for in less than a year—some in as few as five months—through internal programs and not on speculation or the back of potential new business," he says.

Competitive Strategies

To compete, any company can slash prices, either by sleight-of-hand accountancy or by exploiting the wages of employees, Mr. Dwyer observes. However, the key to success, he says, is recognizing opportunity, which often means creating opportunity. To be sure, the manager who exploits his employees' wages is creating a kind of opportunity. History, Mr. Dwyer says, shows this tactic doesn't work. It may make one individual wealthy, but it doesn't make for a stable manufacturing environment. Sooner or later product quality suffers, market share falls, and the company goes out of business, failing both its customers and employees.

"Starro has no interest in that kind of scenario," Mr. Dwyer says. "We'd rather invest in technology that will allow us to keep current customers happy and at the same time build a bridge to new market opportunities."

Mr. Dwyer and Starro know that growth isn't infinite and, accordingly, the company has made most of its significant financial commitments based on its current customer base plus a carefully staged approach to gaining strategic market share. Obsolescence, Mr. Dwyer says, is an unfortunate fact of life for both products and companies. To avoid it, a company's growth must hinge on knowing when and where to grow.

Mr. Dwyer adds that while there are many markets that are very big and very profitable, "we know they're dominated by other players, so it would be foolish for us to push into them. That would be just more work for less return. And the value that we could add to a saturated market would be at best minimal. So we try to find markets where we can add real value, or markets that are highly competitive in which our superior technology and capabilities can provide a higher end solution at an extremely competitive price."

Getting More Out Of Less

Mr. Dwyer takes a practical, realistic view of equipment costs—they're pretty much the same in almost any country, he says, once an offset for exchange rate variables is factored in. So, the cost of labor really is the major factor in a lot of sourcing decisions. "A lot of people look at labor as something to be cut because it's not valued-added," Mr. Dwyer says. "For example, how can I compete when some of my off-shore competitors are paying workers per day what I'm paying per hour?"

The answer, according to Mr. Dwyer, is in getting a higher yield from labor. How? First, find a way for workers to become more productive; second, find a way for workers to develop more skills so the product they produce is of higher quality; third, do both.

"If an operator can arrange setups so that he can run ten machines," Mr. Dwyer says, "my cost actually drops while my value goes up. The overriding factor in the labor equation is increasing output or yield through automation—in our case, automating bar feeding. Then, make the labor hour more divisible by giving workers more skills, more opportunity, more decision-making autonomy. And give them the very best technology."

The Competitor Within

According to Mr. Dwyer, an often overlooked advantage to adopting automation technology is its impact on the workforce—not by job elimination, but by enhancing worker quality of life. "Where is the value-added in having a worker manually load bars?" Mr. Dwyer asks. "Does my customer care? No. Why not automatically load bars and let workers do something that is truly adding value, like setups, inspection, and maintenance? The impact on the worker is huge. He changes his view of himself. He's no longer working at manual labor. He's free to broaden himself. He begins to view himself as a technician, someone with a career horizon."

Mr. Dwyer points out that what in fact happens is each operator becomes a "separate company" unto himself. He or she is asked to maintain a production area and figure how best to deliver product. "We give the operators the responsibility for quality and productivity, and we empower them with the best tools. The result is that instead of seeing annual wage increases tracking the industry average of two to three percent, our workers are seeing increases of 5 to 10 percent and higher. Why? Because their growth and skill levels have risen and with that their output.

"The simple fact," Mr. Dwyer says, "is that empowering workers and improving their skills and providing more opportunity allows me to pay higher wages while keeping costs—and prices—down. If an individual's wage has gone up by 10 percent, but his work cell productivity has risen by 40 percent, then the wage issue is a non-issue."

And the key to this kind of success is something Mr. Dwyer calls the "competitor within." "This is an attitude," he says. "We've just decided that we're not going in with a chain saw and cut jobs. We decided instead to compete with ourselves. And the best thing about this is that we're our own best friends, so any moves we make will be smart, effective and in our collective best interest. And we're the ones making the decisions about our future, not someone outside, not the competition, not the market. We're focused on our future, and we're controlling it. And if through technology and empowered workers we can reduce capital equipment by 40 percent, increase productivity by 25 percent and not raise prices to our customers, then something must be working. And it's not magic or miracles."

Read Next

Building Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read MoreRegistration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read More

.jpg;maxWidth=300;quality=90)

.jpg;maxWidth=300;quality=90)