Published

January MBI Grows Faster

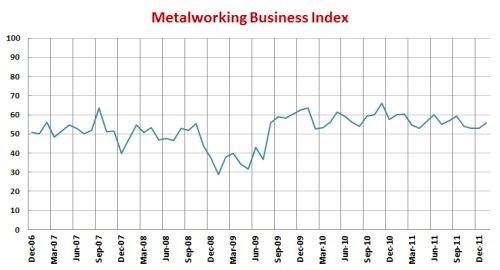

Just when you think the metalworking industry is showing signs of a slowdown, it starts revving back up again.

Share

Hwacheon Machinery America, Inc.

Featured Content

View More

.png;maxWidth=45)

DMG MORI - Cincinnati

Featured Content

View More

January's MBI reading of 55.6 showed a second month of faster growth for the metalworking industry, marking the 30th consecutive month of growth. Just when you think the industry is showing signs of a slowdown, it starts revving back up again.

The three most significant contributors to the improvement in the MBI were new orders, production and backlog. The new orders subindex moved from 53.9 to 59.6. This growth rate was at the same level as the first three quarters of 2011. The production subindex saw an even bigger jump, moving from 54.1 to 61.6. It was the second fastest production growth rate since March 2011. While the production growth rate was faster than the orders growth rate for the fourth consecutive month, the faster growth in new orders was strong enough to cause backlog growth for the first time since September 2011.

The employment subindex remained essentially unchanged in January. However, the rate of employment growth was still strong. January’s index level of 57.4 was noticeably higher than the average of 53.6 since the inception of the MBI. The export subindex fell to 47.8 from 48.2, marking the fourth consecutive month of faster contraction.

In another survey done by Gardner Research, 17 percent of respondents indicated that they did work as part of a reshoring initiative. The change in exports from the MBI and the growth in reshoring clearly demonstrate that metalworking industry growth is a result of American demand. While the world, and even America’s economy continued to struggle, consumer durable goods and capital goods demand remained strong. Supplier deliveries continued to lengthen, albeit at a slightly lesser rate in January. This indicates continued strength throughout the manufacturing supply chain.

Finally, future business expectations moved from 74.9 to 77.4, which was a significant increase in expectations since October 2011. Also, this was the second highest level of expectations since December 2010.

.JPG;width=70;height=70;mode=crop)

.png;maxWidth=150)