Share

Takumi USA

Featured Content

View More

Autodesk, Inc.

Featured Content

View More

Hwacheon Machinery America, Inc.

Featured Content

View More

.png;maxWidth=45)

DMG MORI - Cincinnati

Featured Content

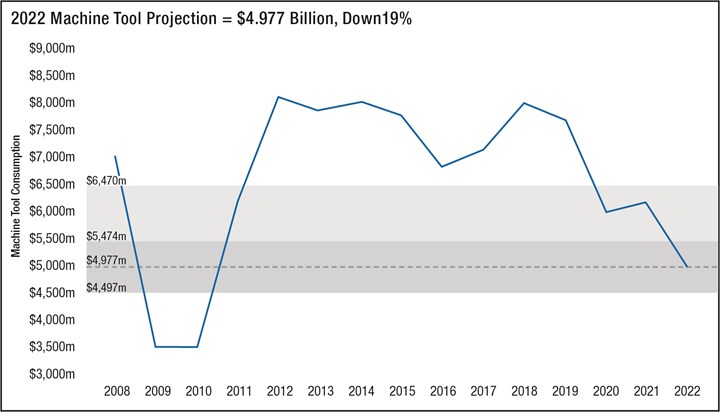

View MoreThere’s no sugarcoating a 19-percent drop. According to the annual Metalworking Capital Spending Survey from Gardner Intelligence, a division of Modern Machine Shop publisher Gardner Business Media, this is the projection for year-over-year U.S. machine tool spending in 2022.

Turning machine spending is one bright spot in this year’s projections. All images courtesy of Gardner Intelligence.

Photo Credit: Getty Images

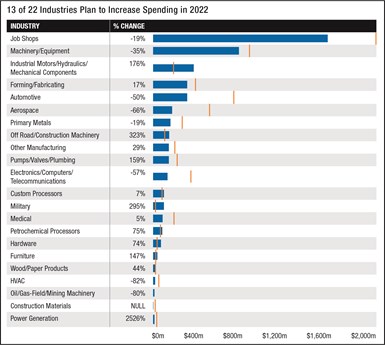

That said, a more granular look at the data reveals bright spots and pockets of opportunity. Outside the high-profile automotive and aerospace industries, spending is projected to increase in certain key sectors, and on certain types of equipment. And, at least at the time of this writing, the metalworking industry overall continues to expand.

The Numbers

Opening in July and concluding in August of every year, the Capital Spending Survey leverages Gardner Business Media’s unparalleled reach into smaller facilities with manufacturing NAICS codes (those that have less than 20 employees represent a significant percentage of our supplier base). Each respondent answered detailed questions about how they plan to invest in capital equipment in 2022. Available from Gardner Intelligence, the resulting report breaks the data down by company size, geographic region and markets served, and also offers granular data on equipment types and other investments (such as software spending, HMCs by pallet size, gantry versus pick-and-place robots).

As might be expected in the current environment, spending forecasts are not positive. However, given supply chain challenges and overly pessimistic forecasts for last year, manufacturers could be bringing 2022 spending forward to account for lengthy delivery times.

Highlights of this year’s data include:

- Overall, spending on metalworking capital equipment in 2022 is expected to reach $4.98 billion. Compared to past years’ surveys, this 19-percent overall decline in projected spending follows a decrease of 15% in 2020 ($6.0 billion) and an increase 2.4% ($6.147 billion) in 2021.

- Shops with fewer than 100 employees are projected to spend more than those with more employees, as they have for the past several years. In fact, the majority of this $2.96 billion of small-shop spending comes from shops with fewer than 20 employees. In comparison, shops with 100 or more employees are expected to spend $2.02 billion.

- “Improving productivity/efficiency” is the top motivation for machine tool spending for the third year in a row.

- Machining center spending is projected to be $2.262 billion in 2022, a year-over-year decrease of 15%. However, there are bright spots, with industrial motors, off-road construction and military spending projected to increase by $150 million, $90 million and $63 million, respectively.

- Grinding and screw machine spending are also projected to decline in the coming year across most industries. Here again, projections foresee expanding sales by custom processors and oil, gas and mining more than doubling in 2022.

- Another projected growth opportunity for the industry is lathes/turning centers, which are projected to see $1.458 billion in spending, up 78%. According to our analysts, it is likely that industrial motors, off road/construction and pumps/valve/plumbing are contributing to the projected increase.

- Spending on ram and wire EDM is projected for a significant year-over-year increase. However, small-hole EDM spending is projected to decline.

The full report offers detailed breakdowns by machine type, industry, plant size and state.

Projections in Context

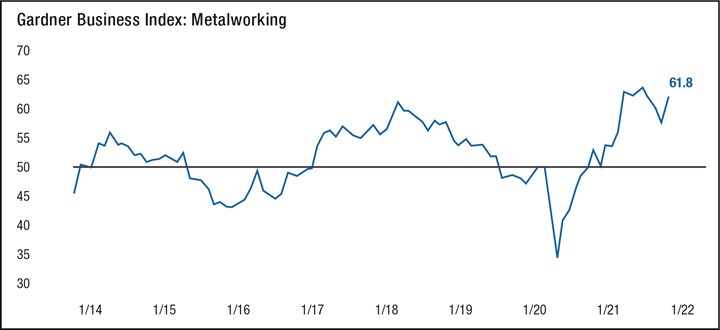

Insightful as the capital spending survey can be on its own, other data from Gardner Intelligence can shape how we think about these projections. Consider the Gardner Business Index (GBI), which is the culmination of a monthly survey of Gardner subscribers consisting of 10 questions about business activity (MMS reports monthly on the latest numbers). As a diffusion index, the GBI is a measurement of proportions, shifting as respondents indicate whether business conditions are contracting, stable or expanding from one month to the next. A number above 50 indicates that a greater proportion of respondents are claiming expanding business conditions than not. A reading below 50 indicates contracting business conditions with a greater proportion of respondents reporting weakening business conditions than those who are reporting expanding conditions.

The Metalworking Index signals increasing expansion in business activity in October as employment expands. Meanwhile, disrupted supply chains are severely impacting production and keeping backlogs elevated. More information is available in our monthly monthly GBI report.

As seen in the graph above, the general trend for the GBI has been one of slowing expansion in the third quarter. However, as this article was being written, the metalworking portion of the GBI (numbers are also available for specific industries) increased four points, to 61.8. This increase was broad-based, with most components of October’s GBI: Metalworking index reporting accelerating expansion. The most significant contributor to the increase was a marked growth in employment activity, one of six indices that factor into the overall GBI. Specifically, the acceleration in the metalworking GBI’s employment index indicated that the proportion of shops reporting growing payrolls was greater than the proportion reporting shrinking payrolls.

However, our analysts caution that this metric should not be interpreted as heralding any dramatic reversal of labor shortages, which extend beyond manufacturing and (like so many societal ills) have been exacerbated by the pandemic. Other challenges reflected in the downward trending GBI prior to this latest reading include shortages in critical components like semiconductors, which account for poor automotive industry projections; lack of demand for aircraft; and generally unprecedented uncertainty that makes planning difficult. This uncertainty is illustrated in GBI respondents’ planned spending. Since the inception of the index in 2011, the average expected spending amount by metalworking facilities in the next 12 months has averaged $624,000. Planned spending was approaching that amount until it leveled off at $483,000 in the third quarter of this year.

Down is Not Out

Nonetheless, even with the decline from June through October, the GBI has been in positive territory for months — historically positive territory, in fact. Although aerospace and automotive are contracting, projections for industrial motors, hydraulics, mechanical components and off-road/construction machinery equipment are all trending above five-year averages. The forming/fabricating, medical and (despite semiconductor shortages) electronics sectors continue to report expanding business activity as well.

As for the capital spending projections, these figures are just that — projections — and a look back reveals some of our most recent projections to be overly pessimistic. That is, Gardner’s projections for 2021 indicated that total capital spending would be $5.092 billion, but our latest estimate of actual spending is up 2.4 percent, to $6.147 billion. The extent of this discrepancy is large compared to those of past years. Our analysts speculate that this could reflect manufacturers ordering early, thus bringing their 2022 spending forward into 2021 to compensate for expected lengthy deliver times.

Finally, projections are a snapshot in time — a time of not just uncertainty, but also industry-wide change for the better that might not always be reflected in investment forecasts. Digitalization; lights-out machining and automation; outside investment and transitions in ownership and business practices; reshoring — these and other developments provide the context for the continued publication of Modern Machine Shop stories about how supply-strained shops are actively unchaining new opportunity.

Thanks to all who have already participated in answering our detailed questionnaires. Gardner Intelligence will continue to monitor the numbers, and MMS will continue to publish new GBI results every month. We also encourage readers to visit gardnerintelligence.com to not only learn more, but to participate in surveys like Capital Spending and GBI, the quality of which will improve as base sizes expand.

Read Next

Registration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read MoreBuilding Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read More

.png;maxWidth=150)

.jpg;maxWidth=300;quality=90)

.jpg;maxWidth=300;quality=90)