February Metalworking Activity Continues January’s Uptick

Gardner Intelligence's Metalworking Index readings reveal an overall gain, with increased new orders and production activity.

Share

.png;maxWidth=45)

DMG MORI - Cincinnati

Featured Content

View More

ECi Software Solutions, Inc.

Featured Content

View More

Autodesk, Inc.

Featured Content

View More

Hwacheon Machinery America, Inc.

Featured Content

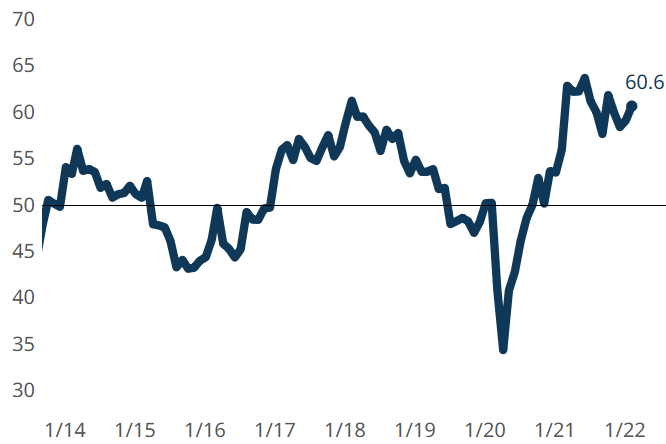

View MoreFebruary closed with a Gardner Business Index: Metalworking reading of 60.6, indicating that the Metalworking Index this month closely mirrored that of January. Increased activity in readings for New Orders, Production, and Backlogs contributed to the month’s overall gain.

Gardner Business Index: Metalworking for February 2022

Images courtesy of Gardner Intelligence.

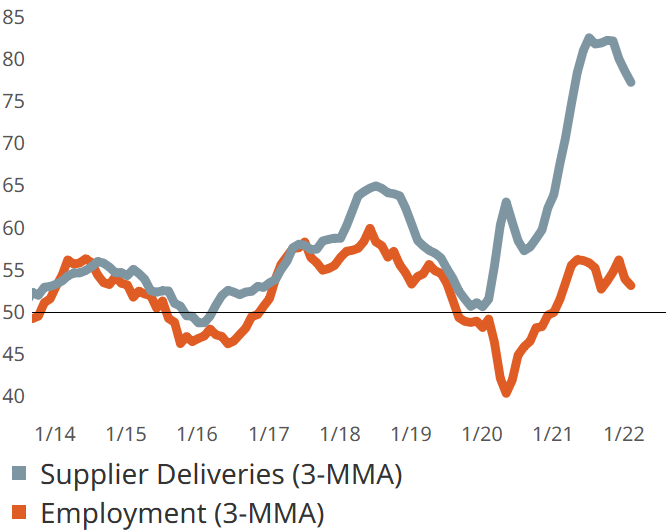

Supplier Deliveries and Employment Readings

Lengthened supplier deliveries at a slowing rate also continued into January. This trend would be concerning under typical business conditions, but instead it indicates a relief from some out-of-the-ordinary dynamics at play on GBI today. Employment activity showed expansion at a slowing rate for the second month in a row while Export activity contracted a bit faster in February.

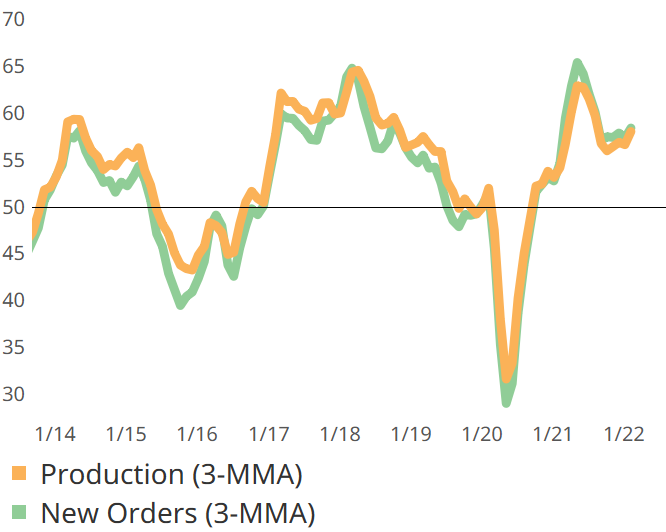

Metalworking Production and New Orders

Based on a three month moving average.

Based on a three month moving average.Longer-term trends within GBI: Metalworking show the Production Index that dipped in October has since been on a path that converged with New Orders in January and held into February. These two indices typically trend similarly in ‘normal’ conditions, however, convergence in current conditions suggests adoption of creative solutions to boost production since employment and supply chain conditions remained anything but helpful.

Related Content

-

Metalworking Activity Stabilizes in July

July closed at 44.2, which interrupts what had been three months straight of accelerating contraction.

-

Market Indicators Continue to Soften in Metalworking

The overall metalworking index is down more than a point, but future business is up slightly.

-

Metalworking Activity Trends Down Again in June

The Metalworking Index closed at 44.3 in June, down 1.2 points relative to May, marking a 2024 low.

.png;maxWidth=150)