ComauFlex: Automation as Strategy

You can’t buy one. But you can buy into this approach to highly efficient automotive assembly automation.

Share

Hwacheon Machinery America, Inc.

Featured Content

View More

Takumi USA

Featured Content

View More

It isn’t often that you have someone parse a sentence for you (at least not since you’ve graduated), but David C. Reid, PMP, product and solutions business manager, program manager R&D, Global Solutions Development, Comau Inc., does just that.

The sentence: “ComauFlex is a comprehensive, production proven, flexible BIW manufacturing strategy that is solution-focused as opposed to component-driven.”

But before we get to that, a word about Comau, and why this is a company that is particularly relevant for those who are involved in auto manufacturing.

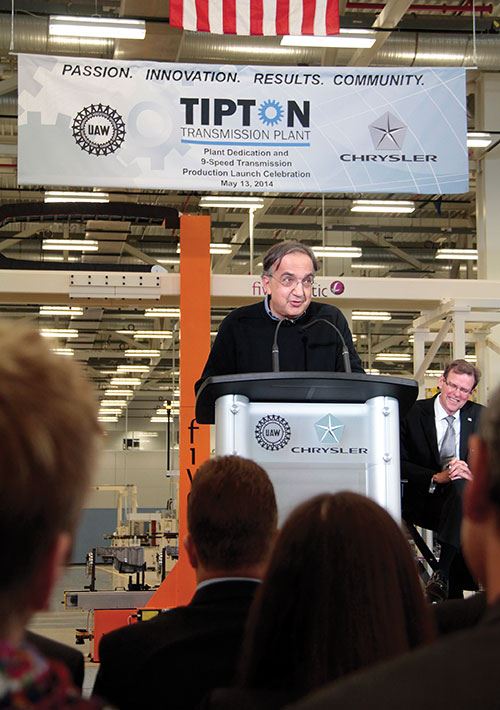

Early in May, the executive cadre of Fiat Chrysler Automobiles, led by Chairman and CEO Sergio Marchionne, gave a comprehensive, hours-long, presentation on the present and future of the companies, brands and divisions that make up the company. Most of the attention among those covering the event understandably focused on the plans for Chrysler (increasing NAFTA deliveries from 332,000 in 2013 to 770,000 by 2018) and Alfa Romeo (from 0 in NAFTA in 2013 to 150,000 by 2018—Mr. Marchionne is nothing if not optimistically aggressive).

But there was another presentation that was important enough, apparently, for Mr. Marchionne himself to deliver on May 6.

There were 21 presentations in all. Mr. Marchionne made the opening presentation and the closing presentation. He gave a presentation on the outlook for the NAFTA region. And he gave one on Ferrari (no real surprise there).

But among the presentation on things like Jeep and Ram, Fiat and Maserati, there was one that Mr. Marchionne made titled “Components.” He talked about Magneti Marelli, a producer of lighting, exhaust systems, powertrain components, suspensions and other parts and systems. He talked about Teksid, a manufacturer of cast iron and aluminum castings—blocks, heads, exhaust manifolds, crankshafts and camshafts.

And Mr. Marchionne talked about Comau. He described it as “an innovative global leader in automation across a wide range of key technologies, with fully integrated capability in product, process and service solutions.”

The point is this: You would not hear GM’s Mary Barra or Ford’s Mark Fields talk about “automation across a wide range of key technologies,” because their companies make cars, trucks and components, not the means by which those products are produced.

And when the boss—the BIG BOSS—not only knows about your company, what it does, and how well it does it, when the boss talks about what the outlook is for the company and how he expects it to grow, when the boss knows that the production of those Grand Cherokees and 500s, 1500s and 300s, depends on the performance of the automation that your company produces, then your stuff better be awfully damn good. So we go back to Mr. Reid and the parsing of the sentence.

“Comprehensive means that we don’t consider ourselves to be a manufacturer or a tooling company, but a solutions provider,” Mr. Reid says. “The ComauFlex strategy is comprehensive because it takes into account the entire manufacturing operation.”

Mr. Reid continues, “Production proven means that every element of ComauFlex is in production somewhere in the world”—think, for example, of Fiat and Chrysler plants—“though no ComauFlex has been deployed as one comprehensive launch.” Not that they’re disinterested in that happening, however.

“Flexible body-in-white manufacturing means we can build a random mix or batch-build different vehicles down the same line, vehicles with unique architectures. We can provide a scalable solution that starts out at a lower JPH [jobs-per-hour rate] and can be expanded to a higher JPH as the customer’s sales increase. We are able to accommodate different materials and joining methods, not just resistance spot welding of steel.” In addition to steel, they’re processing materials including aluminum, magnesium, carbon fiber composites and engineering plastics. They’re not only spot welding, but TIG, MIG, MAG, plasma, laser and projection welding. Clinching, bonding, riveting, brazing and gluing.

There are a couple more aspects to ComauFlex. One is that it is “technologically evolving.” Mr. Reid says, “The body shop we sold to Customer A yesterday isn’t going to be the same as the one we are going to sell to Customer B tomorrow.” There is an emphasis on continuous improvement. The other is that “ComauFlex is a manufacturing strategy, not a thing that you can buy.” Yes, there are key elements, things, like the Versapallet and the Versaroll, but these are enablers that allow manufacturers to realize the benefits of the strategy.

For example, there’s the physical structure of the plant that ComauFlex takes into account, even though Mr. Reid points out, “Comau doesn’t build factories.” When work began nearly 15 years ago on codifying what would become ComauFlex, when the enablers were starting to be developed, one determination was to make equipment that would allow the use of “a lightweight building.” Mr. Reid explains, “Our equipment is engineered to be self-supporting. There is no interface to the building’s truss, no overhead support for conveyors or power-and-free systems. No pits are required in the floor. If it is new construction, the building can have a lower ceiling, so there is less air to process. The building columns can have a wider spacing, which makes it more process friendly for the layout. It can be a less expensive structure.” Clearly, taking into account how the price of the physical factory can be minimized is far more strategic than just considering the reach of a robot. But, of course, to build bodies-in-white, robots are required, and, yes, Comau manufactures robots.

And then there is a consideration of not simply the assembly line itself, but the logistics related to getting the parts to the line. “One of the biggest contributors to reducing the overall plant size has to do with the logistics strategy,” Mr. Reid says. Consider a typical underbody build that consists of 12 components that get added for the build. This means that there needs to be line-side display for each of the parts. There must be space for manual or robotic load. There must be in-feed conveyors to bring the parts line-side. There must be racks to store the parts, two for each, one that’s empty for reloading and one that’s in process. Then if there are multiple models being built on the line, it is a matter of multiplying all of this, which makes the line all the more complicated and lengthy.

Which brings us to one of the enablers, the Versaroll carrier, which transfers components through a line, moving them from station-to-station, powered by an electrical gear motor that activates urethane rollers to effect the movement. An optical encoder monitors the speed and position of each carrier, and assures that carrier moves precisely where it needs to be. Mr. Reid says that they’re looking at a concept wherein all of the components for an assembly would be loaded onto a Versaroll “like a shopping cart” at the start of the line, then at each work station, robots would access the parts as needed. This would eliminate the need for all of the line-side racks and conveyors, thereby shrinking the overall size of the line.

The other enabler is the Versapallet, which is a transfer system that deploys a precision geometry tooling pallet to move a body through the line; it replaces fixed underbody tooling and thereby facilitates the processing (as in respot and framing, for example) of several models on a common system.

One of the aspects that Mr. Reid emphasizes about both of these is that there is a high degree of commonality in the layout. In a given line, there is what is called a “BRIC,” or “Basic Robot Integrated Configuration.”

Essentially, this is a single steel structure with three or four robots suspended from the bottom of a platform and all of the necessary controllers on top. There are two BRICs per station, one on each side of the line, with the transfer device running down the middle. Stations are based on a 22-ft. transfer pitch, so BRICs are positioned accordingly. Mr. Reid explains that these are standard devices: “Every BRIC is the same.” The BRICs are all built ready to go by Comau and simply integrated at the user’s site. And “simply” it is, as it is primarily a matter of installing anchor plates to the floor of the factory, then locating precision rods that are used to position the BRIC, then bolting it in place. The piping and wiring are ready to be plugged in.

This facilitates line reconfiguration and expansion as needed.

They’re looking at various other aspects to improve ComauFlex (remember the “what we sold to Customer A yesterday. . .”). Like remote monitoring of equipment performance and using AGVs to replace fixtures so as to provide near-infinite model flexibility.

As Mr. Marchionne works toward 2018, when they’ll be building Jeeps well outside factories in Detroit and Toledo, when they’ll be aiming at increasing sales in North America by some 48 percent, you can be confident that ComauFlex will continue to evolve.

Related Content

Inside the Premium Machine Shop Making Fasteners

AMPG can’t help but take risks — its management doesn’t know how to run machines. But these risks have enabled it to become a runaway success in its market.

Read MoreUsing the Toolchanger to Automate Production

Taking advantage of a feature that’s already on the machine tool, Lang’s Haubex system uses the toolchanger to move and store parts, making it an easy-to-use and cost-effective automation solution.

Read MoreTranslating a Prototyping Mindset to Production

The experimental mindset that benefited BDE Manufacturing Technologies as a prototype job shop has given it an adaptable edge as a production facility.

Read MoreHow to Accelerate Robotic Deburring & Automated Material Removal

Pairing automation with air-driven motors that push cutting tool speeds up to 65,000 RPM with no duty cycle can dramatically improve throughput and improve finishing.

Read MoreRead Next

5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read MoreRegistration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read MoreBuilding Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read More

.jpg;width=70;height=70;mode=crop)

.png;maxWidth=150)

.jpg;maxWidth=300;quality=90)