January Income Down, Spending Up – What Gives?

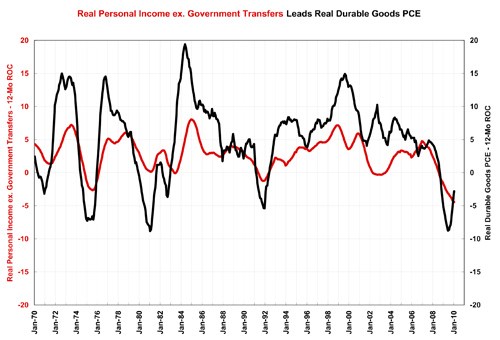

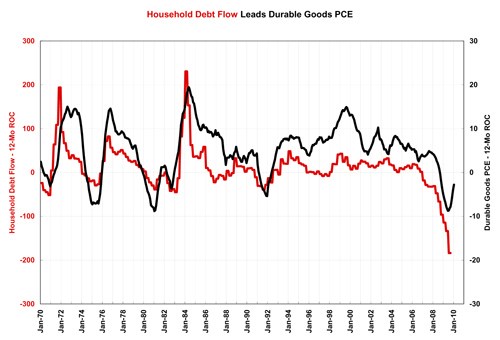

So, if income, a leading indicator for spending (see the third chart), is still falling how can spending be going up?

Share

Real personal income includes all job-related income, dividends, rental income and more. However, I exclude government transfers (such as unemployment benefits, Social Security payments and more) from my analysis because they are not earned income but simply a transfer of income from group to another. Therefore, these transfers don’t provide truly additional money for spending.

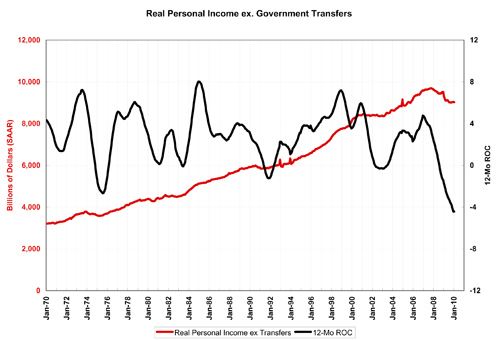

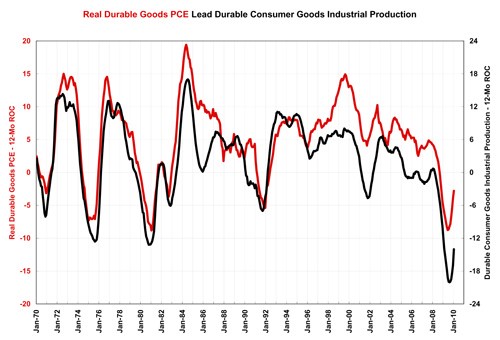

In January, real personal income excluding government transfers was 3.0% less than in January 2009, according to the Bureau of Economic Analysis. This measure of income has fallen 6.9% from its peak in September 2007. Since it bottomed in September 2009, real personal income excluding government transfers is up just 0.2%. The first chart also shows the 12-month rate of change curve I use to show that income is a leading indicator for consumer durable goods spending. The rate of change curve shows that incomes are contracting faster year over year each month. The rate of contraction is easily the fastest in the last 40 years.

Read Next

Setting Up the Building Blocks for a Digital Factory

Woodward Inc. spent over a year developing an API to connect machines to its digital factory. Caron Engineering’s MiConnect has cut most of this process while also granting the shop greater access to machine information.

Read MoreRegistration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read More

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)

.jpg;maxWidth=970;quality=90)