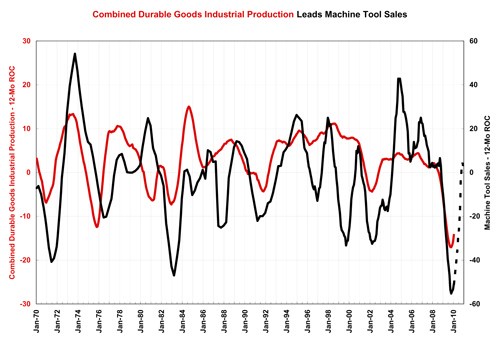

Jan. 2010 Machine Tool Sales Show Significant Growth

According to the USMTC, January 2010 machine tool sales were up 14% and 38% compared to January 2009 in units and dollars, respectively.

Share

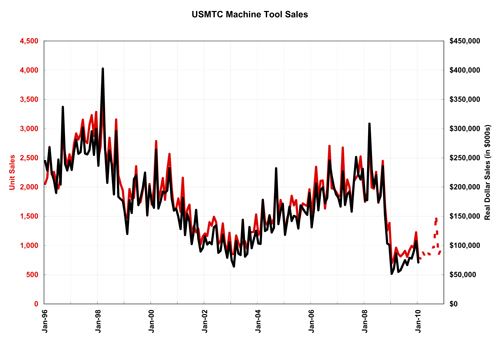

According to the USMTC, January 2010 machine tool sales were up 14% and 38% compared to January 2009 in units and dollars, respectively. This is the first time that unit sales were up month over month since September 2008, and this is the second month in a row that real dollar sales have seen an increase month over month. While I’m still skeptical about the long-term prospects for the economy, there is no doubt that machine tools have hit bottom and are starting to move in a positive direction. The first chart shows unit sales and dollar sales as reported by USMTC. (I show real dollar sales here while USMTC reports nominal dollar sales.) The dotted red line represents my forecast for machine tool unit sales for 2010. In January my unit forecast (created in October 2009) was just 2% lower than actual unit sales. Keep in mind that the USMTC report doesn’t capture the entire market and that participation in the survey has increased over time.

Read Next

Building Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read MoreRegistration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read More

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)