Transferring Your Business When There Is No Clear Leader

Say your business is owned by multiple owners—for example, two or more brothers and/or sisters; or cousins; or aunts/uncles; or two or more unrelated (by blood or marriage) owners; or any combination of the foregoing. Assume the business has prospered, and so have the owners.

Say your business is owned by multiple owners—for example, two or more brothers and/or sisters; or cousins; or aunts/uncles; or two or more unrelated (by blood or marriage) owners; or any combination of the foregoing. Assume the business has prospered, and so have the owners. Everyone gets along fine when it comes to running the business.

But mention transfer of ownership or succession planning, and no one can agree on price, terms, when or to whom to make the transfer, and what to do if someone dies, retires or becomes disabled.

Why? My experience pinpoints one main reason: the lack of a single, in-charge and in-control voice. When there are multiple owners, each additional voice complicates problems. Don't forget that these multiple owners may have spouses—more voices.

If an owner dies before a comprehensive transfer/succession plan is in place, there are two winners: the IRS and the lawyers. Everyone else—the family of the deceased and the surviving business owners—loses.

We put in a succession plan for five brothers (each owning 20 percent of Success Co.). Two brothers were not active in the business. Of the three business brothers, two had kids in the business. The brothers could not come up with a satisfactory succession plan.

The process of solving the problem may be more important than its solution. Following are the nine steps we've used for 21 years.

- We requested, received and reviewed information (the four items listed at the end of this article) from each brother.

- We interviewed each of the brothers separately to get their long-range goals for themselves, their families and Success Co.

- We arranged an all-day meeting with all of the parties involved.

- We drew a tight agenda crafted from what we learned in items 1 and 2 above and by asking each brother and the company lawyer and CPA (both of whom attended the meeting) for items they would like to discuss.

- We opened the meeting by having each brother recite his goals. With minor exceptions, they were true to those expressed in the telephone interviews.

- We made three lists: A) items everyone agreed to (such as "want the business to continue in the family"); B) minor disagreements; and C) major disagreements.

- Of course, we knew (from our advance preparation) what would be on the lists.

- Next, we gave a sort of seminar on what strategies (mostly how to resolve tax and emotional issues) to use and how each strategy would fit into a plan. The A) items were easy; the B) items (with one exception that became a C) item) were conquered without too much difficulty; the C) items took almost half of the day. All issues were resolved during the meeting except one.

- We implemented the plan in following months while working on the open issue.

In the end, we created separate wealth transfer/estate plans for each brother. Each plan dovetailed with the transfer/succession plan of Success Co. Thus, the process solved the brothers' problem of making their individual goals and plans fit with their brothers' (and Success Co.'s) goals and plans.

If your company has a transfer/succession plan problem, you can join our reader test. We will report the results in this column. If you want to participate, please send me the following information (copies, not original documents) for each owner.

- A current personal financial statement and recent tax return (Form 1040).

- A family tree, with names and birthdates for the owner, spouse, kids and grandchildren. Indicate who is in the business.

- Estate documents, including wills and trusts for the owner and spouse.

- The business' year-end financial statement, tax return and a list of stockholders.

Let's hear from you.

Related Content

10 Things to Know About Creep-Feed Grinding

Because of the high material removal rate creep-feed grinding can deliver in challenging materials, grinding might not be just the last step in the process—it might be the process.

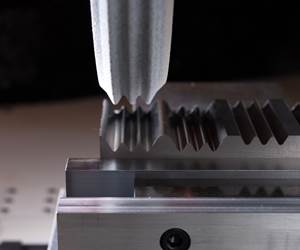

Read MoreSpeeding Up Splines

Moving small- to medium-batch production from outsourced, dedicated hobbing operations to in-house, CNC multitasking machines helps job shops achieve quick turnarounds and flexibility in supplying splines for the heavy-vehicle industry. Inserted disc cutters make this transition possible.

Read More6 Machine Shop Essentials to Stay Competitive

If you want to streamline production and be competitive in the industry, you will need far more than a standard three-axis CNC mill or two-axis CNC lathe and a few measuring tools.

Read More4 Steps to a Cobot Culture: How Thyssenkrupp Bilstein Has Answered Staffing Shortages With Economical Automation

Safe, economical automation using collaborative robots can transform a manufacturing facility and overcome staffing shortfalls, but it takes additional investment and a systemized approach to automation in order to realize this change.

Read MoreRead Next

Inside Machineosaurus: Unique Job Shop with Dinosaur-Named CNC Machines, Four-Day Workweek & High-Precision Machining

Take a tour of Machineosaurus, a Massachusetts machine shop where every CNC machine is named after a dinosaur!

Read MoreThe Future of High Feed Milling in Modern Manufacturing

Achieve higher metal removal rates and enhanced predictability with ISCAR’s advanced high-feed milling tools — optimized for today’s competitive global market.

Read MoreIncreasing Productivity with Digitalization and AI

Job shops are implementing automation and digitalization into workflows to eliminate set up time and increase repeatability in production.

Read More

.jpg;maxWidth=300;quality=90)