What It Takes to Be a Top Shop

Leading machine shops share signature traits. This year’s Top Shops benchmarking survey reveals what some of those traits are.

Share

Read Next

Click on the graphic above for infographic highlights from the

2014 results of the Top Shops survey.

We launched our Top Shops benchmarking survey in 2011 to enable shop owners and managers to compare their operations’ practices and performance with those of industry leaders. This way, they can identify optimal operational and business approaches that define world-class competitiveness in discrete parts manufacturing.

Although we slightly modify the survey each year, we’ve maintained a core of key questions that we ask in each survey. That way, we can begin identifying trends by comparing new survey data to that from previous years. This article touches on some of those trends and is based on survey analysis and observations from me and Steve Kline Jr., director of market intelligence for Gardner Business Media (the publisher of Modern Machine Shop).

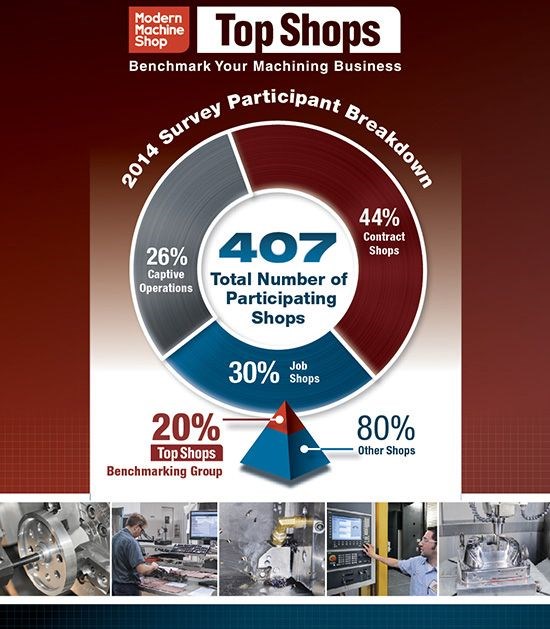

This year’s comprehensive survey was made available early this year to North American job shops, contract shops and captive organizations. It presented questions grouped into categories including machining technology, shopfloor practices, business strategy and human resources. There were 407 shop representatives who participated in the survey. In exchange for doing so, we provided them with reports that compared all survey responses based on the type of shop, number of employees and number of parts produced last year.

In addition, a Top Shops benchmarking group was established. This benchmarking group represents the top 20 percent of machining businesses—a group that is determined by totaling the points assigned to select survey questions. The following looks at some of the similarities and differences between that elite benchmarking group and the other shops that participated in the survey. However, responses for all survey questions are available in our free 2014 Top Shops Executive Summary that can be accessed at mmsonline.com/topshops.

Who Participated?

This year, approximately 45 percent of surveyed businesses are job shops (independent shops that primarily perform short-run and other non-repeating work), 34 percent are contract shops (independent shops that primarily have contracts for repeating part numbers) and 21 percent are part of a captive operation.

Survey data over the last four years show that Top Shops tend to serve a wider variety of industries than other shops, suggesting that they are better able to develop processes around their resources to take advantage of hot markets. More than 55 percent of this year’s Top Shops serve the aerospace industry compared to only 28 percent in the 2012 survey. In contrast, approximately 43 percent of other shops surveyed this year made parts for the aerospace industry. Other leading markets for Top Shops include automotive, military and equipment manufacturing.

Machining Technology

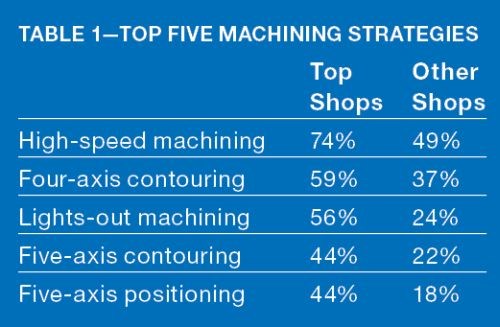

Over the past four years, the percentage of Top Shops performing five-axis positioning and five-axis contouring has increased dramatically, whereas those percentages are virtually unchanged among other shops. This year, 44.4 percent of Top Shops perform these five-axis operations compared to 22 percent (contouring) and 18 percent (positioning) among other shops. While five-axis contouring is the flashier of the two operations, five-axis positioning offers clear advantages in terms of accessing five sides of a fixtured part to minimize setups by performing multiple operations in one fixturing.

The same can be said for lights-out machining. In the previous two surveys, the percentage of shops in our benchmarking group that had integrated such automated processes was in the 16- to 17-percent range. This year’s survey revealed that a higher number of shops in that group have robots: 22 percent. It will be interesting to see how this trend continues, especially as collaborative robot technology advances.

This year’s survey also indicated increased use of multifunction machines such as Swiss-type lathes and turn-mill machines by Top Shops. These machines make it possible to produce parts complete, minimizing setups and work in process. Clearly, the goal in using this equipment is to minimize the number of times a part is touched during production. Similarly, Top Shops continue to be more apt to use HMCs (56 versus 47 percent). When fitted with tombstones, HMCs enable shops to fixture numerous similar parts or part families. In fact, we’ve written about shops that have determined a single HMC can achieve the production rate of multiple VMCs.

In terms of additive manufacturing, the past few surveys have been consistent. Top Shops are more likely to have 3D part printing capability, although only 15 percent of them reported having that equipment this year. Plus, none of this year’s Top Shops use this technology for production work in customer-specified material. Instead, they use this equipment solely for rapid prototyping.

Here is some other key machining equipment that Top Shops apply:

• Advanced and custom tooling. Top Shops are more likely to use custom/specialty tools (74 versus 52 percent). They justify the higher cost of that tooling with the knowledge that they’ll realize improved production and longer cutter life. A much higher percentage of Top Shops have machines with high-pressure coolant delivery (70 versus 44 percent), too. Compared to flood coolant, a directed stream of high-pressure coolant removes a greater amount of heat, enabling higher material removal rates and faster cycle times.

• Tool vending systems. A tool vending system can accurately track every nondurable tool for a job while providing daily tool usage reports. This enables tight cost control and ensures that a shop never runs out of the tools it needs. In this year’s survey, 52 percent of Top Shops reported using these systems, compared to 27 percent of the other shops.

• Advanced workholding devices. Top Shops place higher emphasis on speeding setup and change-over times. That’s why many more of them use devices such as quick-change fixturing (67 versus 41 percent), vacuum chucks (37 versus 20 percent), fixturing for multiple workpieces (78 versus 61 percent) and tool presetters (52 versus 35 percent).

Shopfloor Practices and Performance

Spindle utilization and setup time are two telling shopfloor metrics. This year, Top Shops reported a median spindle utilization time of 75 percent versus 65 percent for other shops. Top Shops also have the edge in setup time. Our survey describes setup time as the time between the completion of the last good piece of the current run and the first good piece of the subsequent run. Top Shops reported a median setup time of 37 minutes compared to one hour for other shops due in part to the advanced workholding strategies mentioned above.

But while all of this year’s surveyed shops have identical median on-time delivery rates of 95 percent, Top Shops have a faster order lead time. For them, the time from receipt of order to customer delivery is 15 days, compared to 21 days for other shops.

The following practices help enable Top Shops to achieve these metrics:

• Lean manufacturing. Top Shops are more likely to implement lean manufacturing initiatives such as continuous improvement programs (85 versus 55 percent), 5S workplace organization (63 versus 42 percent) and value stream mapping (33 versus 22 percent). These efforts enable them to better identify and eliminate wasteful elements of their processes.

• Quality certifications. Nearly 60 percent of Top Shops have quality certifications (ISO 9001, AS9100, etc.), compared to only 45 percent of other shops. This indicates that Top Shops have better process control measures in place.

• Tablets on the shop floor. The survey included an open-ended question asking if and how shops are using iPads and other tablet devices on the shop floor. Compared to other shops, more than twice the percentage of Top Shops use these devices in this way (33 versus 15 percent). Some of them indicate that they are in the early stages of implementing these devices, however, while others have more experience under their belts. Having fully interactive access to process control software enables supervisors to stay close to activities on the shop floor so they can quickly obtain pertinent information and make changes on the spot.

Business Strategy and Performance

There are a variety of business metrics that demonstrate how Top Shops have more effective overall operations compared to other shops. Three of these are median sales per machine ($388,888 versus $127,000), median sales per employee ($186,000 versus $113,000) and profit margin (15 versus 5 percent).

As Steve Kline points out, from 2010 to 2013 (the years the Top Shops surveys have covered), U.S. durable goods manufacturing has gone from the worst contraction in history to the fastest growth in nearly 30 years and finally to a slower, yet still robust rate of growth. However, most of the period covered by the Top Shops surveys has been identified with a slower rate of growth in durable goods manufacturing.

Therefore, it is no surprise that Top Shops and other shops have seen their sales growth rates fall by almost one third over the last couple of years. Yet, this year’s survey shows that sales at Top Shops continue to grow at nearly twice the rate of other shops. While the growth rate of sales has slowed at all shops, other sales metrics show that Top Shops continue to use their resources more efficiently. At Top Shops, median sales per machine has nearly tripled while median sales per employee has increased nearly 50 percent compared to the 2011 survey. In contrast, median sales per machine for other shops has decreased by 25 percent and sales per employee has remained flat over the same time period.

Here are some ways Top Shops stand apart from other shops from a business perspective:

• Quote-to-book ratio. This metric really is only pertinent to job and contract shops. Taken on its own, this ratio doesn’t really demonstrate how well a machining business is performing. In theory, a shop could have a quote-to-book ratio of 100 percent, meaning it won every job for which it offered a bid. However, if the shop’s profit margin is poor, it is either quoting too low or simply doesn’t have a good handle on generating accurate quotes. It could also mean the scrap rate is really high, eating into profits. What’s interesting about this year’s survey findings is that Top Shops and other shops have the same quote-to-book ratio of 60 percent, but the successful shops are more profitable.

• Online presence. A much higher percentage of Top Shops have a company website to promote their business (85 versus 45 percent). Even so, some machine shop websites are very basic, essentially providing contact information and an equipment list. Others do a much better job of explaining what a shop is all about. In addition, Top Shops’ use of YouTube videos to market their capabilities has increased from approximately 5 percent in the 2011 survey to 22 percent in this year’s survey. Only 7 percent of other shops surveyed this year use this online medium to promote their business.

• Design for manufacturability (DFM). Top Shops are more likely to offer engineering services to customers in order to refine product designs, simplify machining and lower production costs (56 versus 28 percent). The key for leveraging DFM is to grow a relationship with the customer so shops can offer input early in the product development cycle.

Human Resources

Because Top Shops are increasingly leveraging CAM software to machine the oftentimes complex work they perform, an interesting trend has emerged. In the 2011 survey, Top Shops reported paying CAM programmers slightly less than other shops. Now, the median and average wages for CAM programmers at Top Shops are 16 and 11 percent higher, respectively, than at other shops. In addition, over the last two years, Top Shops have increased the hourly wage of CAM programmers by 13.4 percent and 12.9 percent, respectively. This is easily the most significant increase in wages among all employee categories in the survey.

However, there are other ways that Top Shops recognize the value of their employees. For instance, Top Shops have increasingly used annual review and raise programs, apprenticeship programs, formal safety/health programs, paid medical benefits, and profit- or revenue-sharing plans more so than other shops to help retain their good employees. Recognizing the value of a highly skilled workforce, nearly 52 percent of Top Shops reported offering reimbursements for work-related education in this year’s survey, compared to just 29 percent of other shops.

Over the last four surveys, the amount of formal training offered by Top Shops and other shops has been similar. This year, however, 12.5 percent of Top Shops reported offering 40 or more hours of formal training, which is much higher compared to the past couple of surveys.

Top Shops Executive Summary

This article touches on just some of the interesting findings from this year’s benchmarking survey. I suggest that you visit mmsonline.com/topshops to view our comprehensive 21-page Top Shops Executive Summary. This report compares responses to all survey questions from our elite Top Shops benchmarking group with the other shops that participated in the survey. We’ve also developed a custom digital magazine edition that can be accessed at that web page containing articles, videos and profiles of the four Honors Program winners for 2014.

I’m thankful to those who participated in this year’s survey. Our next survey goes live in January, and I hope you’ll consider taking part in it.

Related Content

The Human Impact of Machining Technology

SSP’s commitment to adopting the latest machining technology benefits not only the business, but its employees as well.

Read MoreTop Shops 2024 Is Now Live

The Top Shops 2024 survey for the metalworking market is now live, alongside a new homepage collecting the stories of past Honorees.

Read MoreTop Shops: Designing a Shop to Meet Customer Needs

Working closely with customers and making careful investments has enabled this Wisconsin machine shop to tackle difficult jobs with tight deadlines as a core part of its business.

Read MoreAutomated CAM Programming – Is Your Software Really Delivering?

A look at the latest automation tools in Autodesk Fusion 360 software and how forward-thinking machine shops and manufacturing departments are using them to slash delivery times and win more business.

Read MoreRead Next

The Future of High Feed Milling in Modern Manufacturing

Achieve higher metal removal rates and enhanced predictability with ISCAR’s advanced high-feed milling tools — optimized for today’s competitive global market.

Read MoreInside Machineosaurus: Unique Job Shop with Dinosaur-Named CNC Machines, Four-Day Workweek & High-Precision Machining

Take a tour of Machineosaurus, a Massachusetts machine shop where every CNC machine is named after a dinosaur!

Read MoreIMTS 2024: Trends & Takeaways From the Modern Machine Shop Editorial Team

The Modern Machine Shop editorial team highlights their takeaways from IMTS 2024 in a video recap.

Read More

.jpg;maxWidth=300;quality=90)