Smart Shops Will Continue to Invest in New Technology

Although our latest survey shows that spending on machine tools will slow in 2016, it’s an “investor’s market” for metalworking companies with vision and boldness.

Demand for machine tools was expected to be quite strong in 2015, based on Gardner Business Media’s annual Capital Spending Survey and on key leading indicators such as capacity utilization and money supply. In anticipation of this strong demand, machine tool builders produced and/or imported many machines. As it turned out, however, actual machine tool demand in 2015 was weaker than anticipated, creating an imbalance between supply and demand. Accordingly, the excess supply of machines has resulted in a buyer’s market for these products.

It may be more appropriate to call this situation an investor’s market, however. That is because metalworking companies should approach the purchase of a machine tool as investors, not as mere buyers or consumers. Before we explore how this shift in outlook might influence capital equipment spending in 2016, we need to understand what was driving these supply and demand trends in 2015.

Reasons Behind the Weaker Demand

Each summer, Gardner surveys readers of this magazine and three of its sister publications about their plans for spending on metalworking capital equipment, workholding and tooling in the following year. Responses to these surveys are used to forecast spending by industry on specific machine, workholding and tooling types.

In July 2014, when companies were completing the 2015 Capital Spending Survey, automotive capacity utilization was reported at its highest level in 25 years (since that time the report of capacity utilization has been revised to a lower level by the Federal Reserve). Not only was the initial report surprisingly high, but so was the timing, because July is historically one of the weaker months for automotive capacity utilization. I believe this unexpected rise in utilization of machining assets in the automotive sector led many shops to overestimate their capital equipment needs and is one reason why demand moderated in 2015.

Coinciding with this spike in automotive capacity utilization, aerospace orders were at an all-time high in July 2014, reaching 1.5 times the next highest month of orders and five times the average level of orders since January 1986. This incredible spike in aerospace orders most certainly also influenced the expected demand for machine tools in the following year.

Both the automotive and aerospace industries are still performing quite well according to most measures, but their rates of growth have slowed. This, in addition to most of the general leading indicators that I track, indicates that demand for machine tools should continue to weaken in 2016.

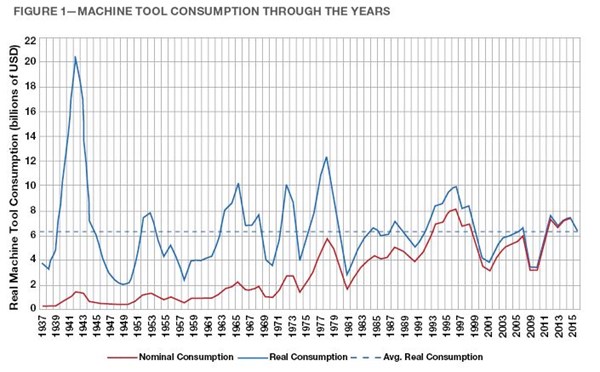

Machine tool consumption is expected to drop 14 percent to $6.2 billion in 2016. That level of consumption is almost exactly what the historical average has been, in real dollars, since 1937.

A second reason that machine tool demand was weaker than expected this year was the steep decline in the price of oil from June 2014 to August 2015. Prior to this period, oil prices had risen fairly steadily for three years, and based on the annual rate of change, they had been increasing at an accelerating rate for nearly two years. This trend toward higher oil prices was a very positive sign for growing machine tool consumption in 2015, because rising oil prices are a sign of a strengthening economy, which typically leads to increased consumption. As it was from June 2014 to August 2015, the annual rate of change in the price of oil fell to -40 percent, which was its third worst crash since 1964. This crash is likely to lead to a lower level of machine tool consumption in 2016, as well.

A third reason for the weaker machine tool demand in 2015 was an historic increase in the value of the U.S. dollar. The dollar index had been relatively stable for the 24 months prior to July 2014, and the annual rate of change had been growing at a decelerating rate during that time period. This trend indicated strong demand for machine tools this year. But, just like the price of oil, the value of the U.S. dollar took a sharp turn—but in the opposite direction. Since July 2014, the rate of change in the dollar has skyrocketed. In fact, it has since been growing at its fastest rate in history (more than 15 percent year over year, as of August 2015).

The rapid strengthening of the dollar hurt machine tool demand in three ways: 1) it made U.S. manufacturing exports more expensive, 2) it made all imports into the U.S. less expensive, and 3) it allowed foreign builders to hold down machine tool prices while maintaining reasonable profit margins in their home countries.

Because currency changes tend to lead machine tool consumption by at least one or two years, the strength of the U.S. dollar in 2015 should put a drag on machine tool consumption in 2016. Numerous factors may strengthen or weaken the dollar next year, interest rates and quantitative easing (money printing) being the most significant. Higher interest rates and lower quantitative easing tend to strengthen the dollar. Currently, this is the direction the Federal Reserve is taking.

Why the Supply Was High

In addition to lower-than-expected demand for machine tools in the year, the supply of machines was too high in 2015. I believe the main reason for this was the relative weakness of the Chinese machine tool market combined with the relative strength of the U.S. machine tool market.

World machine tool consumption peaked in 2011 and has steadily fallen since. This decline can be attributed mostly to softening demand from China, which officially is the world’s largest machine tool market. In 2011, China’s machine tool consumption was valued at about $41 billion, or 40 percent of total world consumption. In 2016, I estimate that China’s consumption will be as low as $24 billion. This drop in Chinese consumption over these five years represents 77 percent of the world decline in machine tool consumption. Because the market in China was so weak and the market in the United States was expected to be strong this past year, builders set their sights on the U.S., ranked as the world’s second largest machine tool market. (Some data even rank the U.S. market as larger than China when the two countries’ “relevant” markets are compared.)

Investor Thinking

Together, the factors mentioned here produced an imbalance between the supply of machine tools and the demand for them, and thus created a buyer’s market, or an investor’s market, as I would prefer to call it. The difference in terms reflects a subtle, but critical, distinction. Whereas buyers tend to focus on price and have a short-term perspective, investors tend to focus on value and maintain a long-term perspective.

Manufacturing, and in particular metalworking, is a very cyclical industry. The buyer mentality follows the herd, while the investor mentality tends to use industry cycles to its advantage, making decisions with a contrarian bent. Buyers tend to make purchases only when business conditions are good or only when the market peaks. Investors make purchases when they get good value, regardless of market conditions.

The following quotes from some of the greatest investors of the last 100 years suggest how to think more like an investor in 2016. These comments should help you focus on what is important as the manufacturing economy slows next year.

“In my opinion, there are two key concepts that investors must master: value and cycles. For each asset you’re considering, you must have a strongly held view of intrinsic value. When its price is below that value, it’s generally a buy. When its price is higher, it’s a sell. In a nutshell, that’s value investing.”—Howard Marks, author of “The Most Important Thing: Uncommon Sense for the Thoughtful Investor”

When you are looking at a new machine tool, or deciding between two machine tools or competing technologies, do you have a strongly held view of what it will be worth to you over its lifetime? How much profit will the machine yield versus its cost? What is this new machine’s profit potential versus the existing machines on your floor? Is it time to part with some older technology to make room for some newer technology?

“The single greatest edge an investor can have is a long-term orientation.”—Seth Klarman, author of “Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor”

Demographics, the overall characteristics of a population, play a significant role in long-term trends that will have a great impact on U.S. manufacturing. Do you know what those trends are and how they will affect your business? A presentation I saw this fall indicated that positive demographic trends point to the U.S. manufacturing economy experiencing a substantial boom in the next 10 to 20 years, while many of the other manufacturing powerhouses (China, Japan and Germany, for example) show fairly negative demographic trends. Do you have a long-term strategic plan to make sustained investments in your business to capitalize on these demographic trends without getting caught up in short-term cycles?

“Price is what you pay; value is what you get.” —Benjamin Graham, author of “Security Analysis” and “The Intelligent Investor”

For many shops, a new machine tool requires a significant cash outlay. It is easy to focus on price when making comparisons. The numbers are right there in front of you. But an investor also considers value. That means comparing quality, capability, strategic fit, service/repair time, engineering support from the builder and so on.

“It is impossible to produce superior performance unless you do something different from the majority.”—John Templeton, renowned stock investor and businessman

“Value investing is at its core the marriage of a contrarian streak and a calculator.”—Seth Klarman

Modern Machine Shop’s annual Top Shops benchmarking survey shows that the best metalworking facilities have more sales per machine, more sales per employee and, most importantly, higher profit margins than 80 percent of the other shops participating in the survey. What are these shops doing differently? How are they being contrarians? The so-called Top Shops make a higher level of sustained investment in capital equipment, whether in absolute dollars or a percent of sales. These shops realize that they need to invest in the latest technology to remain competitive in the global manufacturing marketplace. As manufacturing enters the down part of the cycle in 2016, are you prepared to go against the grain and continue to invest in your business?

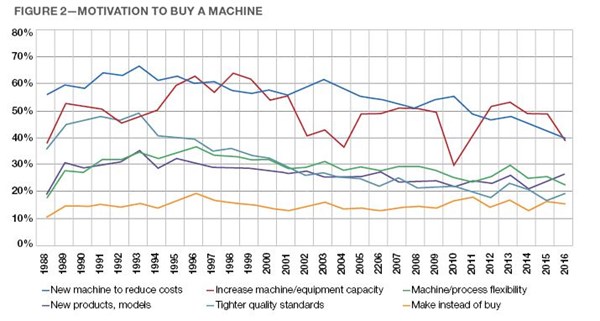

More companies are motivated to buy a new machine tool product or model in 2016 than at any time since 2006. This motivation to buy generally has trended up since the 2009 recession.

As you begin to think like an investor, let’s take a look at a few of the numbers and trends from the 2016 Capital Spending Survey. You can find more details at our corporate website, gardnerweb.com.

Where the Smart Money Will Go

According to the 2016 Capital Spending Survey, machine tool spending in 2016 will be $6.2 billion (see Figure 1). This will be down 14 percent from my latest estimate for 2015; however, this level of investment is right at the historical average for machine tool consumption since the 1940s. In addition, this level of investment is virtually the same as in 2008. So, while the overall market will be somewhat lower, it is still remarkably strong. This will allow machine tool investors to have some additional leverage in negotiations with sellers, yet the market is robust enough that they must be prudent with demands.

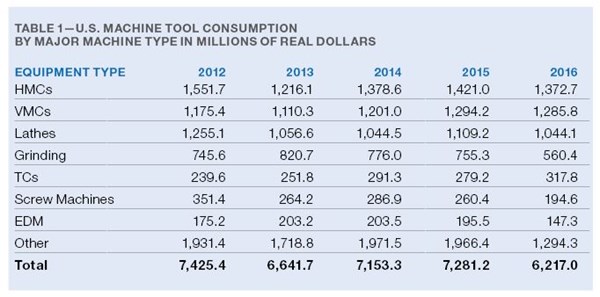

The survey results show the breakdown of anticipated spending on machine tools by the major machine types. For the second year in a row, turning and vertical machines will benefit from stronger spending or more growth in 2016 compared with milling and horizontal machines. For horizontal machining centers and turning centers, spending will be stronger or growing on smaller-sized machines. For HMCs, this means machines with pallets smaller than 400 mm, and for turning centers it includes those with chucks smaller than 10 inches. But the opposite will be the case for vertical machining centers and lathes. In these machine types, more spending or more growth will focus on the larger models. For verticals, this includes machines with a Y axis greater than 20 inches, and for lathes, machines with a chuck greater than 10 inches.

Spending on all grinding machine types (except custom and specialty grinders) are projected to be down in 2016. Additionally, spending on CNC Swiss-type turning machines should drop significantly, while spending on multi-spindle CNC machines should be at the highest level since at least 2008. The multi-spindle CNC market is only one-quarter the size of the CNC Swiss-type machine market, however. Finally, the vast majority of EDM spending will be on wire EDM units.

Spending on tooling is projected to be $4.1 billion in 2016. Although it is down 7 percent from the latest estimate for 2015, this projected level of spending would still be the third highest total since 2002, exceeded only in 2014 and 2015. This modest decline is not surprising, given that durable goods production is near its historic high, yet its rate of growth has been decelerating and will likely contract in 2016.

Workholding spending is trending in a different direction than machine tools and tooling. It is projected to be $2 billion in 2016, which would be an increase of 22 percent compared with 2015. The majority of that spending is expected to be on dedicated fixtures, indexing devices and pallet changers, indicating that shops are focused on increasing their productivity and efficiency. Also, I believe it speaks to the trend over the last five years of rapid adoption of five-axis machining and lights-out machining, as indicated by the Top Shops survey. The right workholding is critical to both of these machining strategies.

Retire Those Old Machines

I would like to make one final point. According to the Bureau of Economic Analysis, the average age of metalworking machinery is virtually the oldest it has been since World War II, and this average has steadily increased since 1950. Top Shops would argue that companies need to invest in new equipment to remain competitive on the world stage. This philosophy is probably one of the reasons why shops in general are expressing a greater interest in new models and new machine types. According to our survey, the percent of shops motivated to buy a new model or machine type in 2016 will be the highest since 2006 and the second highest since 2002 (see Figure 2).

As manufacturing moves into a slower part of the business cycle, it is a great time for shops to investigate what they are going to do next. There is more time to think about, plan and test new processes. What machine, application or process is needed to prepare for the next upturn in the economy? Remember to think like an investor as you answer this question.

Related Content

Same Headcount, Double the Sales: Successful Job Shop Automation

Doubling sales requires more than just robots. Pro Products’ staff works in tandem with robots, performing inspection and other value-added activities.

Read MoreIncreasing Productivity with Digitalization and AI

Job shops are implementing automation and digitalization into workflows to eliminate set up time and increase repeatability in production.

Read More4 Steps to a Cobot Culture: How Thyssenkrupp Bilstein Has Answered Staffing Shortages With Economical Automation

Safe, economical automation using collaborative robots can transform a manufacturing facility and overcome staffing shortfalls, but it takes additional investment and a systemized approach to automation in order to realize this change.

Read MoreAutomating Part Programming Cuts the Time to Engaging Work

CAM Assist cuts repetition from part programming — early users say it could be a useful tool for training new programmers.

Read MoreRead Next

The Future of High Feed Milling in Modern Manufacturing

Achieve higher metal removal rates and enhanced predictability with ISCAR’s advanced high-feed milling tools — optimized for today’s competitive global market.

Read MoreIMTS 2024: Trends & Takeaways From the Modern Machine Shop Editorial Team

The Modern Machine Shop editorial team highlights their takeaways from IMTS 2024 in a video recap.

Read MoreIncreasing Productivity with Digitalization and AI

Job shops are implementing automation and digitalization into workflows to eliminate set up time and increase repeatability in production.

Read More

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)