Medical Industry Strengthens Finances in Second Quarter

Data suggest growing capital spending by medical manufacturers through 2018.

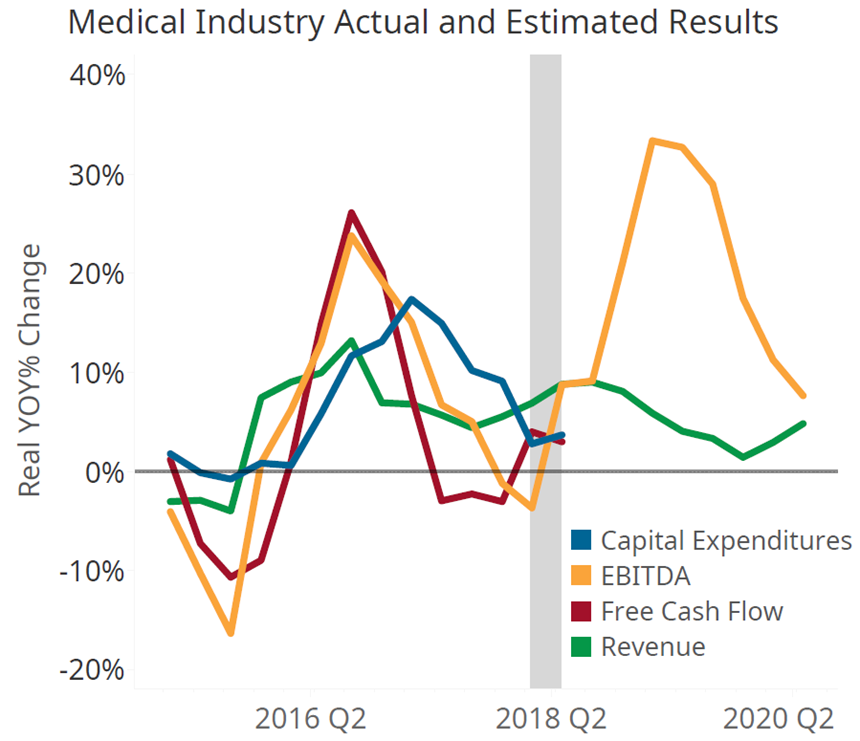

Gardner Intelligence, the research arm of Modern Machine Shop publisher Gardner Business Media, reviewed the medical industry using Gardner’s proprietary data and the second quarter 2018 financial filings results of nearly 70 publicly traded medical firms. The review indicates an industry experiencing growth in revenues, earnings, free cash flow and capital expenditures. The latest quarterly results* signaled a slight increase in the growth rate of capital expenditures. The most significant financial improvement in the industry was in earnings growth, which turned positive during the second quarter after contracting during the preceding two quarters.

Capital expenditures, which includes spending on manufacturing and equipment, grew from 2.8 percent at the end of the first quarter of 2018 to 3.7 percent by the end of the second quarter. This reverses the slowing growth trend in capital expenditures that began after capital spending growth reached a peak of more than 17 percent in the first half of 2017. An analysis of quarterly data between the fourth quarter of 2014 and the second quarter of 2018 indicates a statistically significant relationship between revenue change during a given quarter and capital expenditure change two quarters later. From this simple linear regression analysis – which considers no other factors – and assuming an accurate forecast of revenues based on the consensus Wall Street forecast, this model would predict total capital spending growth of 11.3 percent during calendar year 2018 before expenditures contract by 6.6 percent in 2019.

Data from the Gardner Business Index from manufacturers supplying the medical industry are copacetic with Wall Street’s near-term optimism. According to Gardner’s survey data in the year-to-date period ending in August, manufacturers serving the medical industry have experienced strong growth in new orders, production and – more recently – supplier deliveries.

Several of the business components that constitute the Index have experienced unusually long periods of continuous expansion including backlogs and exports. Backlogs have continued to expand every month since July of 2017, representing the longest continuous stretch of medical manufacturing backlog expansion in recorded history. Similarly, one would have to go back to 2012 to find a stretch of time during which medical manufacturing exports expanded for more than eight consecutive months. Ongoing expansion in new orders and production, along with many months of growing backlogs, suggests that manufacturers are highly likely to close out 2018 in very good condition.

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)