The Real-World Economics Of High-Performance Drilling

To determine true cost, consider the total life of the drill.

Two things can be said about high-performance carbide drills:

- They drill better and faster, and last longer, than high speed or traditional carbide drills.

- They’re much more expensive than high speed or traditional carbide drills.

Do the benefits justify the cost? Not always. And not always in a way that can be seen just by analyzing short-term costs. Evaluating the economics of a high-performance drill involves a range of different factors.

This article examines those factors. A simple but realistic example of drilling work serves as a model. While the numbers used to analyze this job will be based on approximations and assumptions that may not apply directly to a particular shop or application, the logic of the analysis can be applied to a wide variety of drilling work. What this analysis shows is that the cost effectiveness of a given drill may be determined by factors that are far removed from the tool’s initial price.

The Job

The analysis will be based on the simple drilling job pictured below. Here are the specifics:

- The workpiece is made of some reasonably machinable steel, and it is run on a single machining center.

- The production rate for all of the work on this part is 15 pieces per hour, real net average.

- The piece needs four drilled holes, each 0.531 inch in diameter and 1.250 inch deep.

- The job runs two shifts for a total of 16 hours per day, 5 days per week.

- The shop runs at a flat rate of $60 per hour including machine costs, labor and overhead.

Basic Drill Performance

We begin by looking at a basic measure of drill performance: the cutting rate. The two tools compared are a typical, good quality high speed steel drill and a high-performance carbide drill. The numbers shown for speeds and feed rates are based on manufacturer recommendations combined with sound common practice and experience.

Of course the carbide drill is faster. If cutting times are translated into cost, the results look like this:

Basic Drill Cost

Now let’s add some other important information, such the costs of the drills and their expected cutting life.

The carbide drill cuts 2.5 times faster than the HSS drill and lasts 5 times as long, but it’s also nearly 18 times more expensive. As a result, the basic cost of drilling a hole remains high. But one thing that’s not yet a part of our calculations is the drill’s cost and performance after its first life cycle.

Drill Maintenance

The table below shows the basic costs of resharpening the drills. It’s assumed that a standard high speed twist drill can be sharpened in house using any of a variety of relatively inexpensive tool and cutter grinders. The shop rate of $60 per hour is used here. Average sharpening time is assumed to be 5 minutes.

High-performance carbide drills cannot be sharpened using ordinary drill grinders or grinding fixtures. Part of why these drills work so well results from the innovative shapes and geometries on their points. These complex points demand higher levels of grinding precision.

The prices below are typical of sources known to be capable of producing the high-quality points. Coating is a cost that must also be included.

Real Operating Costs

The resharpening cost numbers assume that each drill can be sharpened 10 times before it becomes unfit for continued use. If we combine the cost of buying a drill with the cost of all of its resharpenings, and then consider the long-term overall performance of both types of tools, we ought to get a more accurate view of the true costs involved.

The table below looks at 6 months (25 weeks) of production. Using assumptions already listed, that works out to 120,000 holes.

Inventory Costs

Now the difference becomes clear. Using high-performance carbide drills and a competent resharpening source can reduce the cost of drilling this part by almost 40 percent. However, the analysis is still incomplete. We assumed that carbide drills will be sent outside for resharpening, but what do we use for drills while we are waiting for the resharpened drills to come back? The answer, of course, is more drills. How many more will depend on the turnaround time for resharpening.

At the production rate, number of holes, and drill life we’ve been using, we will wear out roughly two drills per work day. That means we will need two additional drills for every day we wait for regrinding. The number of drills needed to fill this pipeline can be substantial. As the chart below makes clear, controlling the delivery time for resharpening is vital.

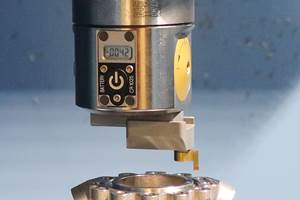

Cost Control

One way to gain control over resharpening work, and at the same time reduce its cost, is to do the work in house. Since ordinary drill sharpening equipment won’t do the job, new equipment will be needed. One example of the kind of equipment that may be needed is pictured on the facing page. CNC machines may be expensive, but in some cases outside regrinding will be more expensive still.

Assume the $60 shop rate we’ve been using all along. That rate includes machine payment, labor and overhead costs. Assume also a grind rate of 10 drills per hour. The table shows the cumulative savings for the 10 resharpenings in the life of a drill.

Final Analysis

The proposed in-house program saves $12 for every resharpening, or $120 over the life of each drill. If these savings are included in the Long-Term Operating Cost Comparison (page 85), then the total drilling cost for the job drops to $15,099. This represents a savings of more than $2,600 compared to outside resharpening, and more than $14,000 compared to the cost of using high speed steel drills.

Keep in mind, these savings apply to just one drill, one job and one 6-month period. For a typical production plant that has even a small number of drilling machines or machining centers, the potential savings stand to be even larger.

About the authors: Kirk Gordon is president of Gordon Engineering (Audubon, Pennsylvania), a maker of CNC drill point grinders. Larry Littleson is president of AWD Associates (Clarkston, Michigan), a Gordon Engineering dealer and also a provider of drill resharpening, reconditioning and recoating services.

Related Content

High-Feed Machining Dominates Cutting Tool Event

At its New Product Rollout, Ingersoll showcased a number of options for high-feed machining, demonstrating the strategy’s growing footprint in the industry.

Read MoreQuick-Change Tool Heads Reduce Setup on Swiss-Type Turning Centers

This new quick-change tooling system enables shops to get more production from their Swiss turning centers through reduced tool setup time and matches the performance of a solid tool.

Read MoreGrooving Attachment Streamlines Operation by 75%

A grooving attachment enabled Keselowski Advanced Manufacturing to reduce cycle times by over 45 minutes on a high-value, high-nickel part feature.

Read MoreHow to Accelerate Robotic Deburring & Automated Material Removal

Pairing automation with air-driven motors that push cutting tool speeds up to 65,000 RPM with no duty cycle can dramatically improve throughput and improve finishing.

Read MoreRead Next

Rego-Fix’s Center for Machining Excellence Promotes Collaboration

The new space includes a showroom, office spaces and an auditorium that will enhance its work with its technical partners.

Read MoreThe Future of High Feed Milling in Modern Manufacturing

Achieve higher metal removal rates and enhanced predictability with ISCAR’s advanced high-feed milling tools — optimized for today’s competitive global market.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read More

.jpg;maxWidth=300;quality=90)